Alternative Financial Services: Essential for Financial Inclusion and Opening Doors to Traditional Financial Services

Alternative Financial Services (AFS) takes advantage of technology-enabled online communities and lending platforms, such as person-to-person (P2P) lending, mobile micro-finance, and crowdfunding, bringing entirely new sources of capital to traditionally underserved populations.

- In 2020, the alternative financial industry facilitated USD 114 billion in transaction volume globally.

- According to the World Bank’s Digital Financial Services report in 2020, access to affordable financial services is critical for poverty reduction and economic growth.

- Financial inclusion is an enabler of Sustainable Development Goals (SDGs) including eradicating poverty (SDG 1), achieving gender equality (SDG 5), and promoting economic growth and jobs (SDG 8).

- BITA’s ESG team researches and provides detailed revenue exposure on companies whose products and services make a positive impact in the world, socially and environmentally.

Financial services as a sector have adapted and changed immensely through digitization and other technological advancements. With each recent decade introducing new technology, financial services increasingly reach more potential clients and offer additional services than before. AFS is distinct from conventional finance channels: banks, capital markets, and government, and consists of three primary categories:

- Fintech financing, takes advantage of technology-enabled online communities and lending platforms, such as person-to-person (P2P) lending, mobile micro-finance, and crowdfunding, among others.

- Conventionally-regarded-informal financing relies on social and business networks such as family loans, trade credits, credit cooperatives, and microfinance.

- Financing practices within corporations and institutions such as insider debt, joint-debt-equity ownership, private debt, and equity.

The largest and fastest growing area is the first, and its main characteristic is that it operates outside of federally insured banks.

Fintech financing provides various models that range from people lending money to each other, businesses exchanging their invoices, to people communally donating to projects. The distinctions between these models are of utmost importance because they target different types of customers, have different purposes, and the number of financial transactions that they operate. The main alternative financial services that currently operate in the market are:

- Peer–to–peer (P2P) business lending: Debt–based transactions between individuals and existing businesses which are primarily small and medium-sized enterprises (SME) with many individual lenders contributing to one loan.

- Invoice trading: Firms sell their invoices at a discount to a pool of institutional or individual investors in order to receive funds immediately rather than waiting for invoices to be paid.

- Peer–to–peer (P2P) consumer lending: Individuals using an online platform to borrow from a number of particular lenders each lending a small amount; most are unsecured personal loans.

- Pension-led funding: allows SME directors to use their accumulated pension funds in order to invest in their own businesses.

- Community shares: refers to a form of share capital unique to co-operative and community benefit society legislation. This type of share capital can only be issued by cooperative societies, community benefit societies, and charitable community benefit societies.

- Donation–based crowdfunding: Individuals donate small amounts to meet the larger funding aim of a specific charitable project while receiving no financial or material return in exchange.

Alternative financial services are a relatively new phenomenon, with a majority of providers less than a decade old. However, their rapid expansion over the world has allowed access to affordable financial services for all scales of society, including the most vulnerable populations. World Bank established that “access to affordable financial services is critical for poverty reduction and economic growth”. This relation is contemplated by United Nations SDGs, which established that financial inclusion ignites faster progress toward the SDGs, and creates long-lasting social and economic impact for millions of people around the world. The use of alternative financial services in Kenya helped lift around 1 million people out of extreme poverty between 2008 and 2014 (SDG 1). Women gained greater economic opportunities and more control over their finances (SDG 5). And businesses were able to access working capital to grow and create new jobs (SDG 8).

At a macroeconomic level, AFS allows financially developed countries to devote capital and risks more efficiently and, therefore, enjoy higher economic growth and reductions in income inequality and poverty. At a microeconomic level, access to financial services can decrease poverty, increase resilience, and improve the living standard for the most vulnerable shares of the population. Financial services unequivocally help “boost earning capacity by enabling investments in their education, health, housing, and businesses and smooth consumption and bolster resilience to shocks such as disease, job loss or a weak harvest through remittances and basic savings, lending, and insurance products”.

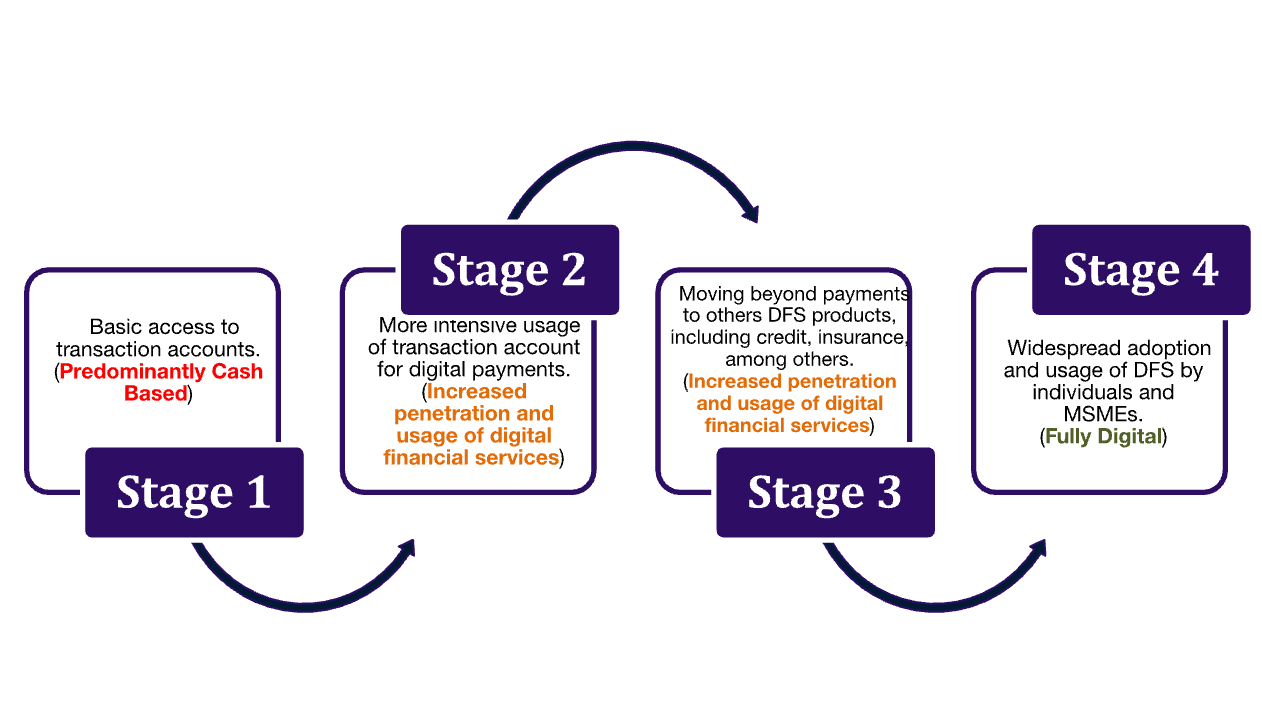

In 2020, the alternative finance industry generated approximately USD 114 billion in transaction volume. AFS is transforming business models in numerous areas of finance to improve the satisfaction of the users, including the poor. The degree of adoption varies among countries (Figure 1), but in all cases, access to alternative financial services is the first step after a cash-based economy and is the precursor to a full offering of traditional financial services for businesses and individuals.

India is a top user of alternative finance in the Asia-Pacific zone (excluding China) (Figure 2). In 2020, the APAC region had a market volume of $8.9 billion, and the total value of alternative finance activities grew by 55% in 2019. Online alternative finance platforms facilitated over $18.5 billion in funding during 2019 and 2020, nearly 38% more than the total volumes collected from 2013 to 2018. Despite a slight decline of 7% in volume between 2019 and 2020, the Asia-Pacific contribution to the global share of alternative finance increased to 8%. This adoption of AFS has facilitated a rapid increase in financial inclusion while also narrowing gaps across different dimensions (Figure 3).

The United States was the top country in transaction volume of Alternative Finance by 2020 (Figure 4), equivalent to USD 73.62 billion, accounting for 65% of the total value worldwide. The US alternative finance market experienced significant growth from 2019 to 2020 across most debt models. In 2020, the P2P/Marketplace and Consumer Lending represented 38% of US alternative finance activity, accounting for $28.08 billion (up 20% against the previous year). It represented the largest US alternative finance model. During the COVID-19 pandemic, the US government started a program to support small and medium businesses, the Paycheck Protection Program (PPP). It provided much-needed liquidity to the economy, employing FinTech solutions and allowing several FinTech firms to operate a P2P/Marketplace and Balance Sheet Business Lending to originate loans under a US Small Business Administration (SBA) loan.

Nevertheless, in 2021, 4.5% of the U.S. households were unbanked, equivalent to nearly 5.9 million U.S. households. Across the 2021 FDIC National Survey of Unbanked and Underbanked Households, the unbanked population consists primarily of lower-income households, less-educated households, Black households, Hispanic households, working-age households with a disability, and single-mother households. This percentage was the lowest since the survey began in 2009 (Figure 5), consistent with the progressive adoption of alternative financial services in the country.

Alternative financial services are a fast-growing and highly diverse market, which is expected to grow by USD 63.35 billion between 2022 and 2027, and are becoming an important source of funding for individuals, businesses, and organizations who often struggle to access funding elsewhere. The improvement of socio-economic indicators such as financial inclusion demonstrates the beneficial effect that AFS brings to society. BITA’s ESG team researches companies making a positive impact, socially and environmentally, and offers Positive Impact universes based on revenue exposure, covering detailed topics such as climate, equality and inclusion, quality of life, and sustainability of resources.

REFERENCES

Allen, F., & Qian, M. (2023). The Competitiveness of Alternative Finance. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4521519

Beck, T., Levine, R., & Loayza, N. (2007). Finance and the Sources of Growth. Journal of Financial Economics, 58(1), 261-300.

Demirguc-Kunt, A., Klapper, L., & Singer, D. (2017). Financial Inclusion and Inclusive Growth: A Review of Recent Empirical Evidence (English. Policy Research Working Paper.

Demirguc-Kunt, Asli; et. al. The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution (English). World Bank. https://documents1.worldbank.org/curated/en/332881525873182837/pdf/126033-PUB-PUBLIC-pubdate-4-19-2018.pdf

Federal Deposit Insurance Corporation (FDIC). (October, 2022). 2021 FDIC National Survey of Unbanked and Underbanked Households. https://www.fdic.gov/analysis/household-survey/2021report.pdf

Technavio. (May 3, 2023). Alternative finance market size to grow by USD 63.35 billion between 2022 and 2027; North America to account for 72% of the market growth – Technavio. PR Newswire. Extracted from https://www.prnewswire.com/news-releases/alternative-finance-market-size-to-grow-by-usd-63-35-billion-between-2022-and-2027-north-america-to-account-for-72-of-the-market-growth---technavio-301813163.html

Schipke, A., et al. (2023). India’s Financial System. USA: International Monetary Fund (IMF). https://doi.org/10.5089/9798400223525.071

UN Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA). (2018). Igniting SDG Progress Through Digital Financial Inclusion. https://sdgs.un.org/sites/default/files/publications/2655SDG_Compendium_Digital_Financial_Inclusion_September_2018.pdf

World Bank Group. (2020). DIGITAL FINANCIAL SERVICES. https://pubdocs.worldbank.org/en/230281588169110691/Digital-Financial-Services.pdf

Ziegler, T. et al. (2020). Global Alternative Finance Market Benchmarking Report: Trends, Opportunities and Challenges for Lending, Equity, and Non-Investment Alternative Finance Models. (Report No.1). University of Cambridge. https://www.jbs.cam.ac.uk/wp-content/uploads/2020/08/2020-04-22-ccaf-global-alternative-finance-market-benchmarking-report.pdf

Ziegler, T. et al. (2021). The 2nd Global Alternative Finance Market

Benchmarking Report. (Report No.2). University of Cambridge. https://www.jbs.cam.ac.uk/wp-content/uploads/2021/06/ccaf-2021-06-report-2nd-global-alternative-finance-benchmarking-study-report.pdf