Corporate America’s Response to Uncertain U.S. Tariff Future

Within days of taking office for the second time, in January of this year, U.S. President Donald Trump announced the implementation of a series of tariffs targeting nations where the U.S. has a deficit. Economies most impacted by these tariffs included China, Mexico, Canada, and the European Union. Trump has said the tariffs will encourage US consumers to buy more American-made goods, increase the amount of tax raised, and lead to huge investments in the United States. He has also made other demands alongside tariffs.

In response to this action, many affected countries sought to negotiate more favorable terms with the United States to avert the risk of a full-scale trade war. Consequently, the application of the new tariffs was delayed by 90 days, except those imposed on China. After talks in Geneva in May, the US and China agreed to cancel some tariffs altogether and suspend others for 90 days. However, both the US and China have since accused the other of violating the agreed terms.

At the end of May, in another development, a US trade court ruled that Trump did not have the authority to impose some of the tariffs because he invoked national emergency powers to do so. This blockage was, however, overruled a day later by an appeals court, and it is expected the case will end up in the US Supreme Court.

The uncertainty caused by increased tariffs and the constant flip-flopping is starting to show up in trade data. The most recent trade report showed that goods imported into the US declined by 20% in April, marking their largest monthly drop ever. US purchases from major trade partners such as Canada and China fell to their lowest levels since 2021 and 2020, respectively.

In response to the tariff uncertainty, businesses have begun to adjust their operations, anticipating considerably steeper tariffs in the near and long term. These have included steps like rushing products into the US before the application of tariffs, changes in production bases (Apple has announced that it will shift the majority of its iPhone production to India), and suspension of revenue guidance in some cases.

Preceding Situation: Growing U.S. Trade Deficit

At the close of 2024, U.S. imports totaled $4.11 trillion, reflecting an increase of $253.3 billion compared to 2023, while exports amounted to $3.19 trillion, an increase of $119.8 billion over the previous year. These amounts resulted in a trade deficit of $918.4 billion, representing an increase of $133.5 billion compared to 2023 and reflecting the ongoing trend of rising trade deficits observed over multiple years. The magnitude of the deficits is shown below, with China having the largest deficit.

U.S. Trade Deficits by Country

Source: Bureau of Economic Analysis

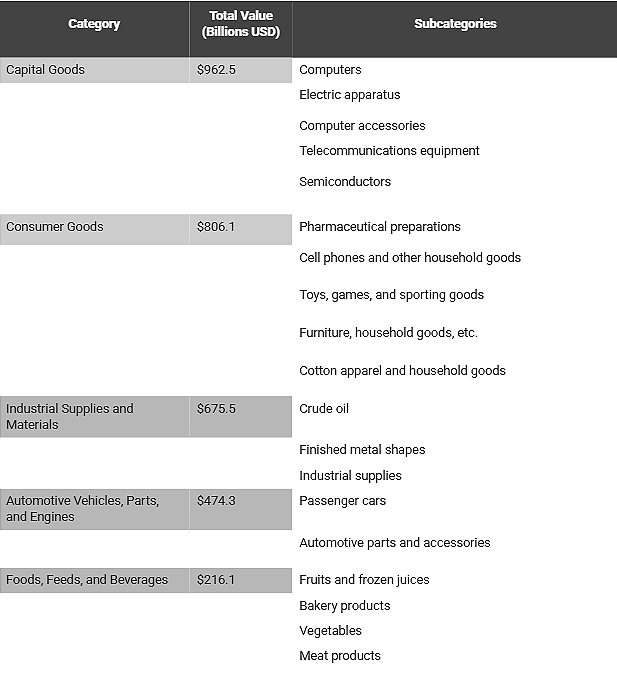

Main Categories of Imported Products 2024

Industry Responds Quickly to Impending Tariffs

On 2nd April, Trump imposed a universal 10% baseline tariff on all imports to the US, on what he called “Liberation Day”. But some nations were subject to much higher rates. Some countries retaliated with their tariffs (in the case of China, a war of words between President Xi and Trump led to the US imposing a 145% levy on Chinese imports, on 9th April, leading China to impose a 125% duty on some US goods). Since the Liberation Day, it has been a case of high tariff announcements, and then some relief in the form of exemptions and extensions, in most cases.

U.S. companies face three primary options in response to pending long-term tariffs: move production and sourcing to the United States, move production and sourcing to countries with lower tariff rates, and risk those countries facing higher tariffs later, or absorb the additional costs imposed by tariffs. Any of these options results in higher cost of goods sold and could necessitate increased prices faced by consumers.

Categorical Summary of Observed Responses:

Future Scenarios for Global Trade Relations

At the time this article goes to print, considerable uncertainty remains. It is expected that while some nations may secure concessions through negotiations, others may face sustained higher tariffs. Given the number of affected countries, the complexity of the underlying trade issues, and the unpredictability of U.S. trade policy under the current administration, the full implications may not be evident for some time.

Projected Sectoral Impacts in the United States

Higher tariffs on imports—irrespective of origin—are expected to create competitive advantages for selected domestic industries, particularly in the following sectors:

- Automotive and auto parts manufacturing

- Computer and electronic component production

- Mobile phone and telecommunications equipment manufacturing

- Pharmaceutical products

- Petroleum refining and distillates

Notably, Chinese imports are expected to face substantially higher tariffs. Consequently, supply chains for U.S. industries that previously relied on Chinese supply chains stand to benefit disproportionately, including:

- Computer and electronic component manufacturing

- Mobile device production

- Toys, games, and sporting goods

- Apparel, footwear, and accessories

- Furniture and home furnishings

Conclusion

Following several years of persistent trade deficits, the United States government, through a start-stop process, is working to implement tariffs on imports as a policy to bolster domestic production and reduce reliance on foreign goods, particularly those originating from China. This has introduced considerable uncertainty both in international trade as well as global financial markets.

Given the current economic volatility, investors must identify which industries and nations are most susceptible to the impact of these proposed U.S. tariffs and monitor and evaluate the evolution of these industries. Such analysis is critical in facilitating well-informed investment decisions.

BITA’s integrated BITACore platform enables users to build highly targeted exposures by constructing baskets and indices from a large universe of global stocks and applying filters based on sectors, themes, factors, and fundamentals, among others. It can be an invaluable tool for investment firms, helping them navigate this uncertain and evolving situation through quick ideation and cutting time to market on product launches.

References

CNBC. The biggest winners and losers in Europe as Trump announces sweeping tariffs. 04/03/2025

T.RowePrice. The losers and (relative) winners of Trump's shapeshifting tariff war. 04/14/2025

The Observatory of Economic Complexity

Trump to tout U.S. investments from Nvidia, J&J, Hyundai, and Toyota. Investing.com. 04/28/2025