Decoding the EU Taxonomy: A Primer for Institutional Investors

The EU Green Deal opened a clear path for investments in "sustainable" sectors by defining and standardizing their classification. The action plan responds to the target set by the EU to reach a climate-neutral economy by 2050 without reducing prosperity and life quality. Such an ambitious goal requires a massive mobilization of capital – at least €1 trillion over the next decade, according to the European Commission[1]. It cannot be covered solely by the public sector, and confers a crucial role to private capital.

In order to achieve the plan, a critical step was to establish a common framework (“EU Taxonomy”) that defines which activities are considered to be “sustainable” economic activities. For example, classifications include renewable energy, circular economy, biodiversity and marine conservation activities. The EU Taxonomy represents a big step to reaching the goals proposed in the EU Green Deal since its correct implementation has critical implications in promoting more environmentally-friendly practices and technologies, preventing greenwashing, and helping shift investments where they are most needed.

Approach and Legislation

The EU Taxonomy Regulation entered into force on July 12, 2020, and was published in the Official Journal[2] of The European Union one month prior.

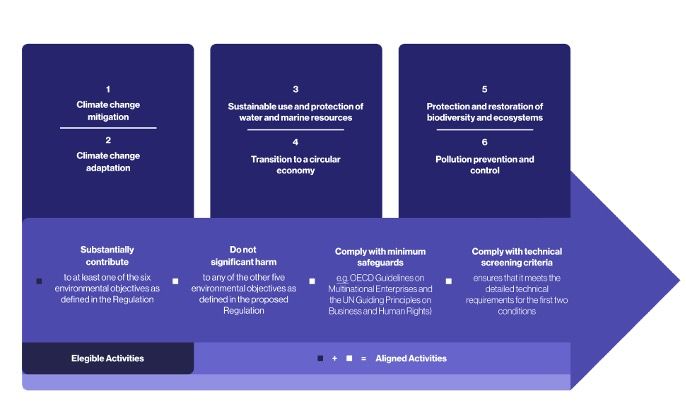

The regulation stipulates eligible activities based on six environmental objectives pursued and the overarching conditions associated (see figure 1). It also requires companies to disclose the proportion of Taxonomy-eligible or Taxonomy-aligned activities contributing to Turnover, CapEx, and OpEx. With the EU Taxonomy already in place, listed companies with more than 500 employees are now required to disclose the extent to which they meet the criteria, starting with the Taxonomy-eligible activities disclosure.

As of January 2023, reporting is also mandatory to disclose the Taxonomy-aligned activities for all large companies covered by the Non-financial Reporting Directive. This implies that around 12,000 companies and groups across the EU will now have to follow the detailed EU sustainability reporting standards. The Commission also proposes a separate and proportionate set of rules for listed SMEs, while non-listed SMEs can use it voluntarily.

Regarding the financial disclosure metrics required, turnover disclosure allows the evaluation of how aligned the current economic activities of the company are on an EU Taxonomy basis, thus offering investors a screening of the share of their funds invested in eligible or aligned activities. The eligible CapEx and OpEx analysis provide investors with company-level insight into transition plans, performance improvements, and environmental sustainability strategies.

About Sustainability-related Disclosure in the Financial Services Sector

As stated previously, the capital flow required for the EU Green Deal confers to the financial sector a major role in the transition towards a climate-neutral Europe, for which the EU has taken significant steps over the past number of years to provide robust and transparency tools for investors to identify sustainable investments. The Taxonomy Regulation also adds specific disclosure requirements for financial institutions and others market participants.

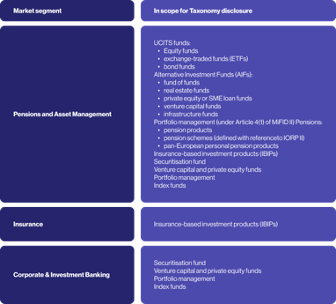

All financial products that are offered in the EU must disclose how and to what extent their economic activity includes, promotes, or finances sustainable projects according to the criteria of the EU taxonomy. For relevant products falling under the SFDR regulation (see chart 1), providers must determine the sustainability of their underlying investments, the associated environmental objectives, and the share of the investments aligned with the EU Taxonomy requirements and goals.

How Investors can adopt the data and analytics available as a result of EU Taxonomy

The EU Taxonomy framework has allowed for standardization, comparability, and transparency of the information used for investment decisions.

The Taxonomy Regulation disclosure requirements create a growing demand for data that aligns with the EU Taxonomy criteria, allowing investors to make informed decisions that promote sustainability, facilitate investment allocation for risk mitigation and give transparency for clients who wish to screen based on sustainability. Investors can use the data and analytics to analyze their investments at a company or portfolio level, and report to clients proportions of Eligible or Aligned investments and details about type of activities. CapEx, OpEX, and Turnover eligibility and alignment reporting indicate forward-looking sustainability practices, facilitate risk mitigation, and enhance long-term performance. Furthermore, they are used as Key Performance Indicators (KPIs). Overall, the availability of data that aligns with the EU Taxonomy criteria empowers investors to make more sustainable investment decisions and contribute to the transition towards a greener economy.

Overall, the EU Taxonomy data and analytics provide investors with valuable information that can help them to make informed and sustainable investment decisions. By adopting these tools and integrating them into their investment strategies, investors can achieve their financial goals while contributing to the broader goal of achieving a more sustainable economy.

BITA’s research teams are seamlessly able to expand our four-tier mappings in Thematic Universes, ESG Impact Universes, and ESG metrics screenings to EU Taxonomy. Collecting data on CapEx, OpEx, and turnover from a diverse range of listed companies is a crucial first step in establishing a foundation for further analysis and evaluation. This data can be leveraged to develop new Thematic Universes that align with the EU Taxonomy, resulting in a more nuanced understanding of the specific activities and practices falling under its purview. Additionally, the Taxonomy framework has the potential to serve as a point of reference for enhancing our current Impact PSA glossary and Impact Universes, thereby enabling us to expand the scope of our analysis.

Sources

1. EU Taxonomy Info Portal; https://eu-taxonomy.info/info/eu-taxonomy-overview

2. European Commission; https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

3. Official Journal of the European Union: https://eur-lex.europa.eu/legal content/EN/TXT/PDF/?uri=CELEX:32020R0852&from=EN

4. EU Taxonomy Info Portal; https://eu-taxonomy.info/info/eu-taxonomy-for-financial-institutions

5. TEG Final Report; https://finance.ec.europa.eu/system/files/2020-03/200309-sustainable-finance-teg-final-report-taxonomy_en.pdf

6. S&P; https://www.spglobal.com/esg/insights/a-short-guide-to-the-eu-s-taxonomy-regulation