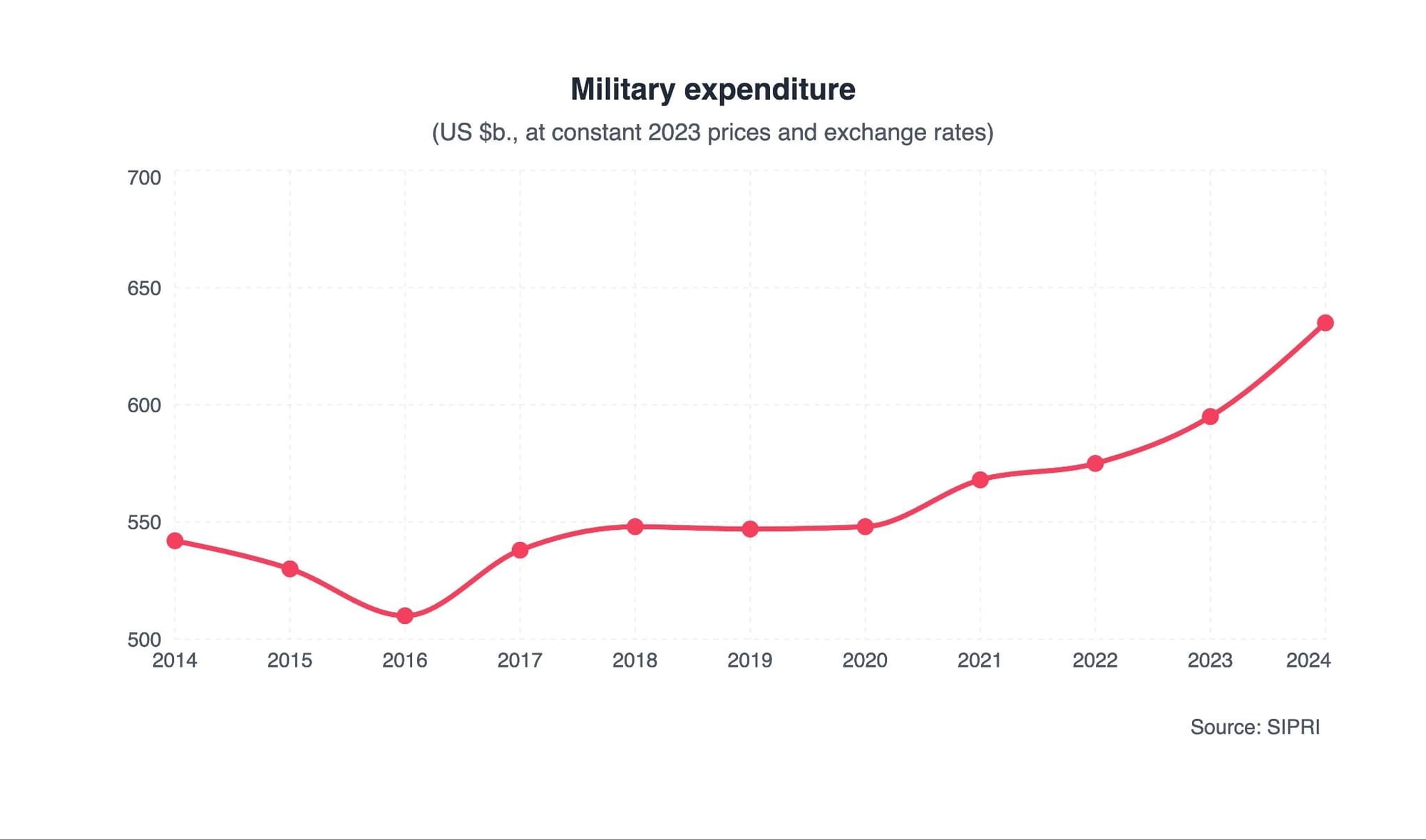

Geopolitical tensions, great-power competition, and technological advancements are driving record military spending and profound industrial transformation.

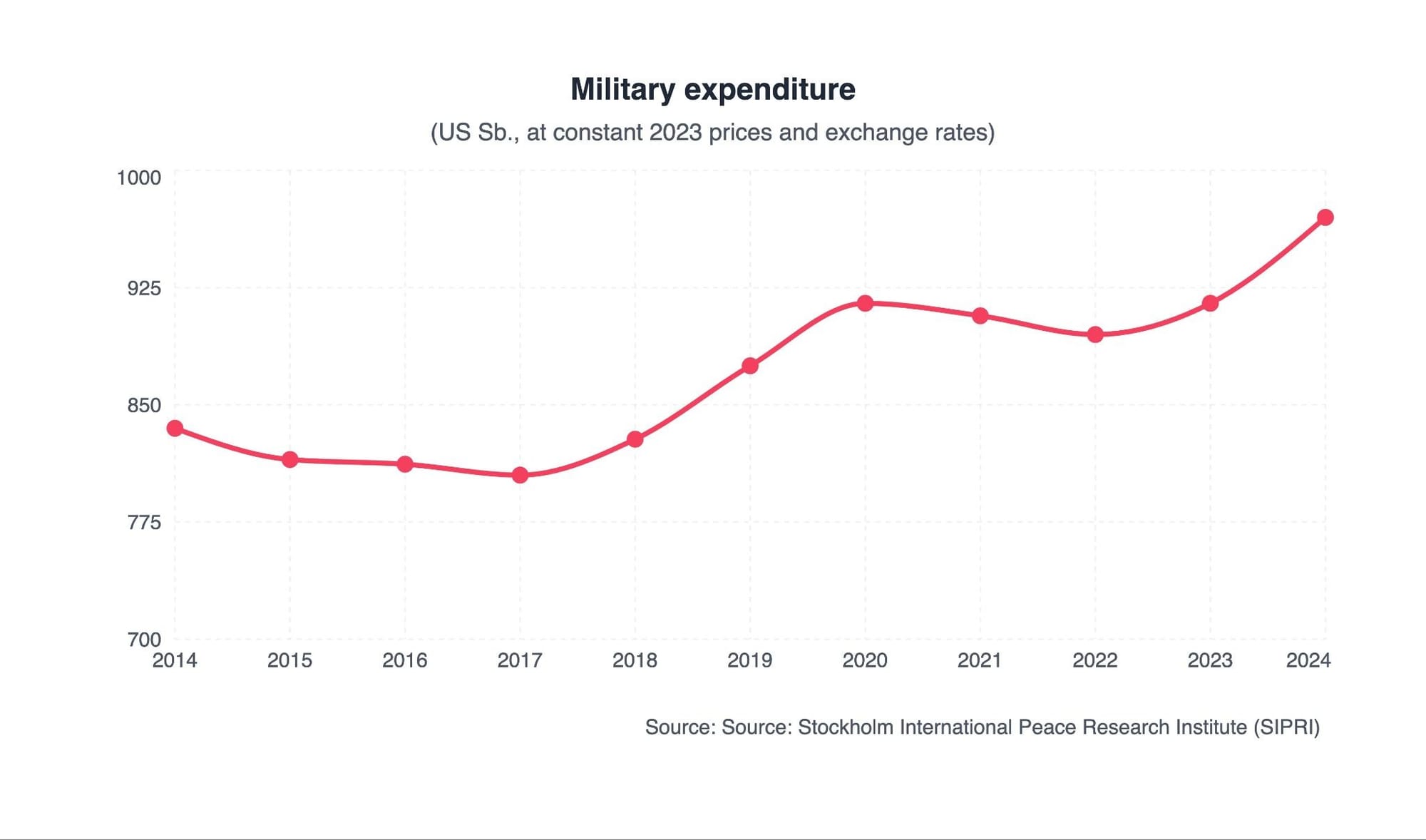

The strategic rearmament of major powers largely fuels this surge; notably, the United States' budget request for Fiscal Year 2025 exceeded $850 billion for the Department of Defense, while European NATO members sharply increased spending following Russia’s invasion of Ukraine. This expanding financial commitment is not merely a reflection of conflict but a strategic investment in next-generation capabilities, fundamentally reshaping the industrial landscape and its priorities.

For the defense industry, this influx of capital is catalyzing a profound transformation, characterized by consolidation, innovation, and supply chain pressures. Prime contractors and subsystem suppliers are scaling production to meet backlogged orders for everything from artillery shells to advanced fighter aircraft. Concurrently, spending is increasingly directed toward disruptive technology domains such as artificial intelligence, cyber warfare, unmanned systems, and hypersonic weapons, compelling traditional firms to adapt and fostering new entrants from the commercial technology sector. This environment demands that companies accelerate innovation and modernize their operations to fulfill contracts and remain competitive. Consequently, the industry is evolving from a platform-centric model to a more networked, software-defined enterprise, with long-term implications for global security dynamics and economic policy.

Global Trend Sees From 7% to 40% growth year over year, Depending on the Country

Expand each section below to view detailed country/regional analysis (all sourced from SIPRI).

Case 1: United States of America

US defense spending has demonstrated a clear and substantial trajectory of growth in recent years, driven by renewed great power competition and evolving global threats. Following a period of relative constraint after the drawdowns in Iraq and Afghanistan, budgets began to rise notably during the latter half of the 2010s.

This trend has accelerated significantly in the 2020s, with the Biden administration requesting and Congress appropriating record peacetime budgets. For fiscal year 2024, according to independent sources such as the SIPRI suggest the military expenditure surpassed $960 billion, continuing a multi-year pattern of increases that consistently outpace inflation.

This growth is strategically directed toward modernizing the military to counter near-peer rivals, notably China and Russia, with significant investments flowing into next-generation technologies like hypersonic weapons, artificial intelligence, cybersecurity, and nuclear modernization, as well as into replenishing stockpiles depleted by support for Ukraine.

This budgetary expansion reflects a broad, bipartisan consensus in Washington on the need to bolster U.S. military readiness and technological edge, even amidst debates over fiscal priorities. The spending increases are not merely a reflection of inflation but represent real growth in procurement, research, and personnel costs.

Key drivers include the rising price tag of sophisticated weapons systems, the strategic pivot to the Indo-Pacific, which demands costly naval and aerial assets, and sustained support for allied nations. Consequently, defense spending has reclaimed a central place in federal discretionary spending, underscoring its role as a top-tier national priority.

This sustained financial commitment signals a long-term strategic shift, moving beyond counterterrorism to prepare for potential high-end conflict, thereby ensuring the defense industrial base remains a powerful and ever-evolving economic and strategic force.

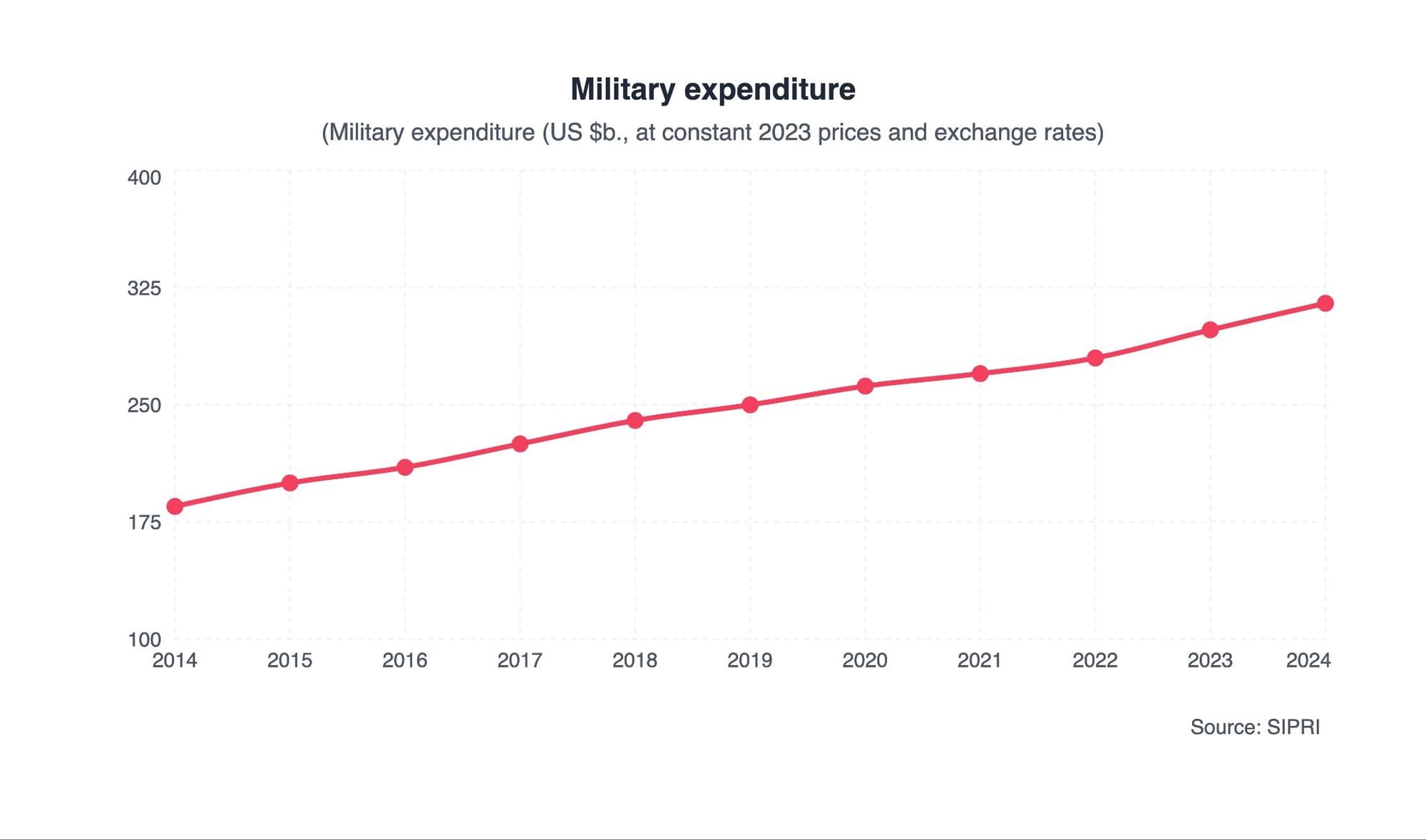

Case 2: China

China’s defense spending has grown steadily over the past decade, reflecting Beijing’s focus on modernizing its military and expanding its strategic capabilities. Beyond the official figures, SIPRI suggest actual Chinese military expenditure has increased year-on-year, rising from roughly US$185 billion in 2014 to approximately US$318 billion in 2024, with consistent increases of around 7.2 % in recent years as part of a decade-long trend of growth. This makes China the second-largest military spender in the world after the United States.

This upward trajectory reflects more than just inflation or routine budgeting: China has been investing heavily in advanced weapons systems, naval expansion, air force modernization, and new domains like cyber and space.

Over the last several years, growth rates have remained positive even amid broader economic slowing, signaling that defense remains a priority for the Chinese leadership. While defense spending relative to GDP has stayed relatively modest (around 1.5–1.7 % of GDP), the sheer scale of China’s economy means its military outlays have a substantial impact on regional and global security dynamics.

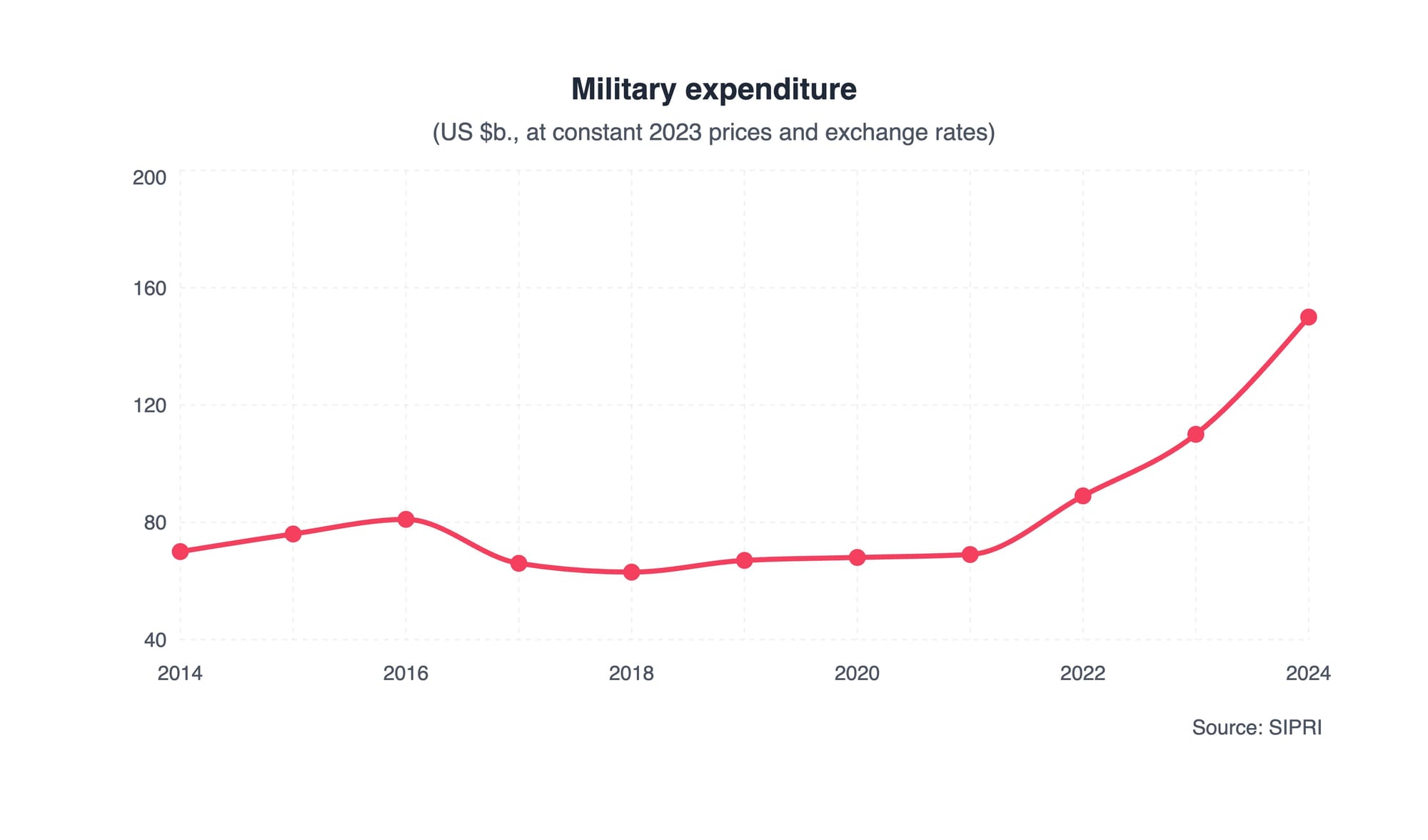

Case 3: Russia

In recent years, Russia's defense spending has undergone a dramatic and sustained surge, fundamentally reshaping its national budget and economy in the context of its war in Ukraine and broader confrontation with the West. Following the annexation of Crimea in 2014, military expenditures began a steady climb, but this trend escalated exponentially with the full-scale invasion of Ukraine in February 2022.

For 2024, officially allocated defense spending reached approximately 6% of Russia's GDP, a Soviet-era level, with actual expenditures, including off-budget items, estimated to be significantly higher. This massive financial commitment reflects a wholesale shift to a war economy, with the state directing unprecedented resources toward arms production, troop salaries, and the procurement of munitions, drones, and armored vehicles. The growth is not merely incremental; it represents a top-priority, all-of-government effort to sustain prolonged, large-scale conventional warfare.

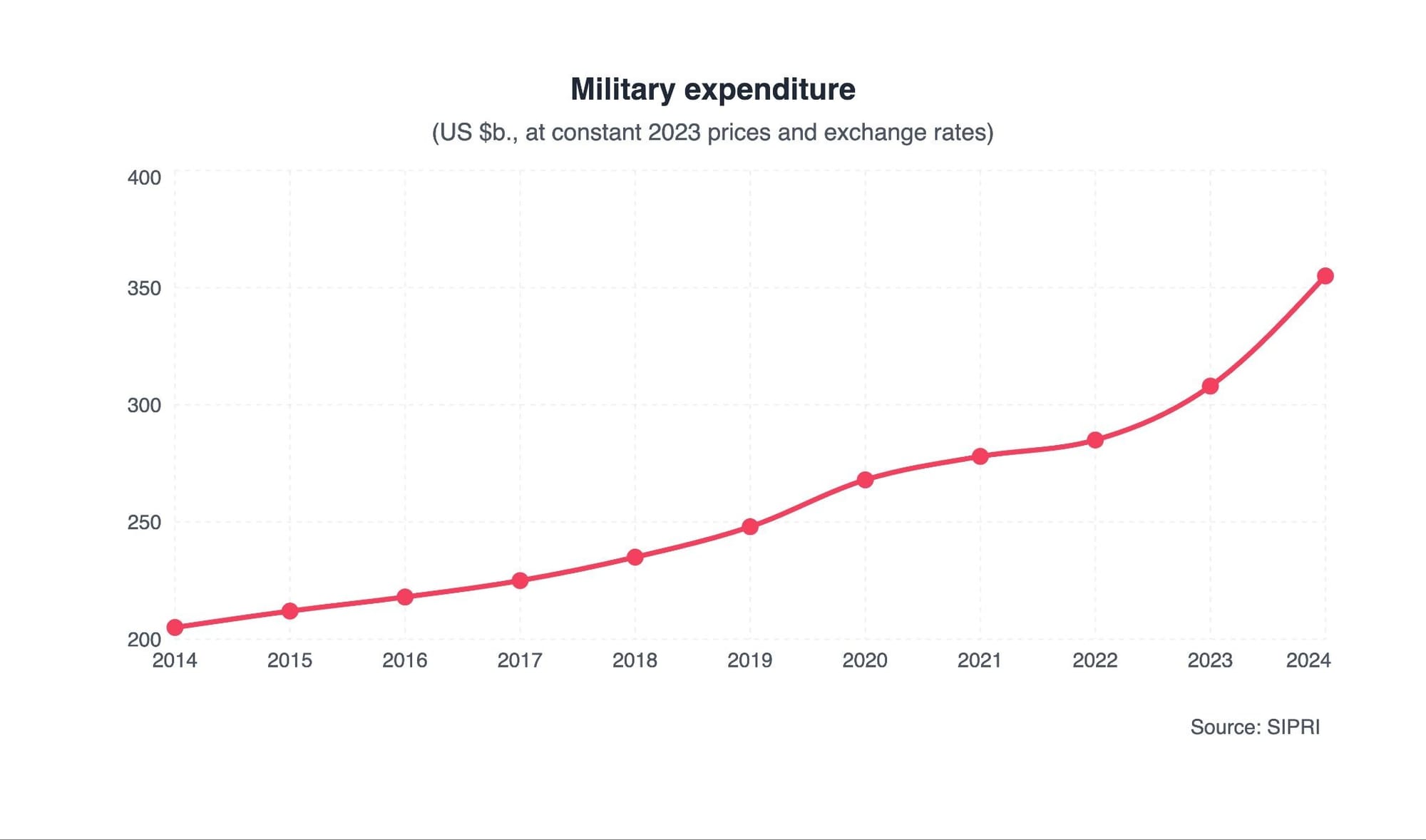

Case 4: Europe

Driven by the profound shock of Russia’s full-scale invasion of Ukraine, defense spending across Europe has undergone a reversal from decades of post-Cold War decline. In 2014, following Russia’s annexation of Crimea, NATO allies agreed to the target of spending 2% of GDP on defense, but progress was slow and uneven.

The war that began in 2022 acted as a strategic catalyst, compelling nations to urgently reassess their security. Germany announced a transformative €100 billion special fund for its armed forces, and a commitment to meet the 2% target, a landmark shift in policy. Similarly, Nordic and Eastern European nations, already vigilant, accelerated existing modernization plans.

This collective response marked the end of the "peace dividend" era, as overall European NATO defense expenditure rose sharply due to governments passing substantial supplementary budgets to replenish stockpiles donated to Ukraine and to bolster their own capabilities.

This growth, however, is not merely a temporary spike but represents a fundamental, long-term recalibration of European strategic priorities. The spending increases are mainly due to tangible military readiness: advanced fighter jets, air defense systems (like Patriot and IRIS-T), battle tanks, and long-range artillery.

There is also a significant push to revitalize and secure the European defense industrial base, aiming to reduce fragmentation and ensure sustainable production capacity for munitions. While the aggregate rise is remarkable, challenges of coordination, bureaucratic delay, and inflation in equipment costs persist.

Nonetheless, the trajectory is clear: Europe is moving decisively toward higher defense spending as a permanent feature of its geopolitical landscape, signaling a new chapter of collective burden-sharing and a recognition that continental security can no longer be taken for granted.

Case 5: Rest of the world

Defense spending across the rest of the world, including major powers in the Indo-Pacific, the Middle East, South Asia, and Latin America, has seen a marked and sustained increase in recent years, reflecting a global trend of heightened regional insecurity and strategic competition.

Nations are responding to a complex mix of threats, including territorial disputes, terrorism, internal instability, and the desire to assert regional influence independent of great power dynamics. In the Indo-Pacific, countries like Japan, South Korea, Australia, and India have significantly expanded their military budgets, driven by concerns over China's assertiveness and North Korea's provocations, investing heavily in advanced naval, air, and missile defense capabilities.

Similarly, in the Middle East, despite fluctuating oil revenues, states like Saudi Arabia, the United Arab Emirates, and Turkey continue to prioritize sophisticated arms acquisitions, driven by ongoing regional rivalries and the perceived threat from Iran.

This broader trend underscores a global shift away from a unipolar security order, as middle and regional powers take greater responsibility for their own defense.

This growth, however, is not uniform and is often constrained by economic volatility and competing domestic priorities. While some nations, particularly in Asia and the Gulf, have pursued ambitious, high-tech modernization programs, others in regions like Africa and Latin America face more modest increases focused on internal security and counterinsurgency.

A key feature of this spending is its strategic diversification; many countries are actively seeking to reduce dependency on any single supplier (traditionally the U.S. or Russia) by sourcing from a wider array of partners, including South Korea, Turkey, Israel, and European nations.

Furthermore, the investments increasingly emphasize asymmetric capabilities—such as drones, cyber warfare, and long-range precision missiles—that offer disproportionate strategic impact for their cost. Consequently, the rise in defense expenditure across the rest of the world is reshaping the global arms market and strategic landscape, fostering more multipolar and self-reliant security architectures, even as it risks fueling regional arms races.

Defense Spending Catalyzes Growth in Select Industries

🔒 Cybersecurity

Defense spending serves as a primary engine for innovation and growth within the cybersecurity industry. Government defense and intelligence agencies, facing sophisticated state-sponsored threats, are among the most demanding and well-funded clients. This drives massive investment in advanced threat detection, encryption, secure communication, and cyber-resilient infrastructure. The need to protect military networks and critical national assets accelerates the development of cutting-edge technologies like artificial intelligence for behavioral analysis, quantum-resistant cryptography, and automated incident response. Consequently, defense contracts provide essential capital for research and development, often funding high-risk, high-reward projects that push the entire field forward and create a specialized, high-skills sector within the broader cybersecurity market. Global Defense Cybersecurity Market is estimated to grow from $40.97 billion in 2024 to $67.94 billion by 2030, a CAGR of 8.8% (Vyansa Intelligence).

🤖 Artificial Intelligence

Increased defense spending directly catalyzes growth within the AI industry by providing substantial, mission-critical funding for research and development. Military agencies, seeking advantages in areas like autonomous systems, cybersecurity, predictive logistics, and intelligence analysis, become major clients and investors. Artificial intelligence spend for defense was estimated at USD 9.31 billion in 2024 and is projected to reach USD 19.29 billion by 2030, growing at a CAGR of 13.0% from 2025 to 2030 (Grand View Research). This influx of capital accelerates technological breakthroughs in machine learning, computer vision, and robotics, often pushing the boundaries of what is commercially viable. Furthermore, the stringent, high-stakes requirements of defense applications drive innovations in robustness, security, and edge computing, which eventually trickle down to commercial sectors. In this way, defense budgets act as a powerful engine, funding long-term R&D that might be deemed too risky or expensive for purely private investment.

✈️ Aeronautical and Space Industry

Defense spending has historically been the foundational catalyst for the modern space and aeronautical industry, providing the sustained investment and demanding technological challenges necessary for breakthrough innovation. In turn, aeronautics is the greatest proportional spend for the largest military budgets anywhere from 10% to 20%. Military requirements for superior aircraft performance, reconnaissance, secure communications, and missile technology have directly driven advancements in propulsion, materials science, avionics, and satellite systems. This funding underwrites high-risk, long-term research that the commercial sector often cannot justify alone, leading to iconic developments from jet engines and stealth technology to the foundational architecture of GPS. Today, defense contracts continue to fuel next-generation projects, such as hypersonic vehicles, resilient satellite constellations, and autonomous drones, ensuring a constant pipeline of cutting-edge engineering and specialized manufacturing that forms the industry's backbone.

🛡️ Materials Technology

Defense spending serves as a powerful and often primary driver of innovation within the material science and manufacturing industry. The pursuit of military advantage creates a relentless demand for materials with extreme properties, lighter weight for fuel efficiency and mobility, superior strength for armor and structures, enhanced thermal resistance for hypersonic vehicles, and specialized functionality for stealth, sensors, and electronics. This demand translates into substantial, long-term funding for fundamental research and development in areas like advanced composites (e.g., carbon fiber), ceramic matrix composites, additive manufacturing (3D printing) of high-performance alloys, and cutting-edge nanomaterials. The stringent, mission-critical requirements of defense applications force rapid iteration and qualification of new materials, accelerating their development cycle and pushing entire supply chains toward higher precision and reliability. Consequently, breakthroughs first achieved for defense, from Kevlar to radar-absorbent structures, frequently transition to revolutionize commercial sectors like aerospace, automotive, sports equipment, and consumer electronics.

📡 Communication

Defense spending has historically served as a foundational catalyst for transformative leaps in the communication industry, directly funding the research and infrastructure that underpin modern global networks. The military's relentless need for secure, reliable, and resilient command-and-control systems has driven breakthroughs from the early development of radar and encrypted radio to the invention of packet-switching (the bedrock of the internet) and the creation of the Global Positioning System (GPS). Today, this dynamic continues as defense agencies invest heavily in next-generation technologies like quantum-encrypted communication networks, low-Earth orbit (LEO) satellite constellations for global broadband, and software-defined radios capable of operating across contested spectrums. This influx of capital and demanding technical requirements accelerates the entire field's innovation cycle, pushing commercial providers to adopt higher standards of security and reliability while underwriting the massive upfront costs of advanced infrastructure.

Conclusions

Defense spending, while driven by geopolitical imperatives and national security strategies, has consistently functioned as a powerful catalyst for industrial and technological transformation. By providing a stable stream of high-stakes, complex contracts, it has historically created entire industrial ecosystems, from aerospace and shipbuilding to advanced electronics and cybersecurity.

This investment not only sustains specialized manufacturing bases but also serves as a primary engine for breakthrough innovation, with civilian applications like the internet, GPS, and composite materials tracing their origins to defense-funded research.

The relationship is symbiotic: defense needs push the boundaries of engineering and science, while the industries that grow to meet these demands gain unique capabilities and economic resilience, albeit often concentrated in specific regions and dependent on government policy.

An example of this type of company, we have RTX Corporations (RTX), L3Harris Technologies (LHX) or Palantir Technologies (PLTR), as they offer products and services to the defense sector as they can also work with the civil sector.

- BITA Drone and Modern Warfare Select Index tracks the performance of companies that derive significant revenue from the drone and modern warfare sectors, including advanced military technologies such as cybersecurity, space warfare, electronic warfare, satellite weapons, and AI-driven warfare.

- BITA Tactical Exposure US Aerospace Index aims to capture the performance dynamics of publicly traded companies that are highly responsive to market movements within the aerospace market.

- BITA AI Leaders Select Index tracks the performance of companies that are at the forefront of AI technologies both from an application and infrastructure perspective.

- US Cybersecurity Giants Index captures the performance of the 25 largest US publicly listed companies with direct revenue exposure to the cybersecurity industry.

Navigate the defense spending boom with precision using BITA's data and indexing capabilities.