ESG Investing – Decoding Impacts and Navigating Outcomes

Economist and Nobel Prize winner Milton Friedman said in the 1970’s that the only social responsibility of a company was to obtain profit.

In the fifty years since then, the concept of corporate responsibility has come a long way, with investors paving the way for companies to report on their efforts. Responsible investing gained momentum in the 1990’s with investors increasingly considering looking beyond the positive and negative impacts of their investments. One of the first established directives in ESG and sustainable in investing was in 2005 with the formation of the United Nations Environment Programme Finance Initiative. It aims for action across the financial system to align economies with sustainable development. Since 2005 the adoption of ESG and sustainable investing has gained increasing momentum. ESG assets under management could climb to more than a third of the projected $140.5 trillion global total by 2025, according to Bloomberg research, assuming 15% growth - half the pace of the past five years.1

Investors today can incorporate ESG and sustainability in many ways: ESG integration, negative screening, norms-based screening, sustainability themed or impact investing, positive screening and investor engagement or shareholder activism. The most commonly employed type is ESG integration, where investors include ESG factors to their analysis and decision-making process to make an investment. And it is the type that we explore in this article.

Public companies disclose their ESG information in an ESG or sustainability report, an annual report or even a separate TCFD2 report. Each of these disclosures benefit investors through easy access to the information. And this information can be factored into investors’ decisions, affecting the price of a company’s stock. To what extent does it affect stock performance and over what time period? According to Hvidkjaer (2017), ESG outperforms other strategies because there is an underreaction in the stock market to ESG information, which means that the market takes longer to recognize the value of firms with good ESG performance. The study demonstrated that investors are able to obtain higher returns from companies with strong ESG performance, if held over the long term.

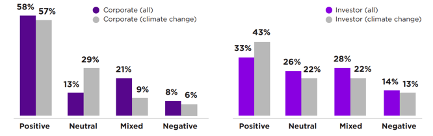

In 2021, Whelan, et al aggregated and evaluated evidence on the effects of ESG investing on financial performance. In the image below you can see that companies that perform better in ESG have better financial performance. And that the correlation is stronger between corporate financial performance and ESG than between ESG and investment performance. Corporate performance is positively affected and better positioned to manage future risks by activities such as managing for a low carbon future, more innovation and a focus on risk management. Furthermore, this improvement in financial performance can be found in the long term but not in the short term.

One important aspect of ESG investing is that ESG integration provides a better performance than negative screening approaches. Note that the results below show a non-negative relationship between ESG performance and outcomes for companies as well as investors, which creates an incentive to be aligned with ESG principles.

The evidence for ESG investing is not all affirmative, however. Another study made by Globerman in 2022, found that the relation between ESG stocks and asset returns is inconclusive. This study reviews the empirical studies that found three types of relations: negative, positive and not significant. Studies that found a negative performance for ESG investing found that “sin” investments provide a higher return, companies with the largest CO2 emissions have higher returns and additionally noted that ESG funds charge higher fees.

The paper presents studies that found no significant evidence between ESG and financial performance and says that even though sustainable practices are a good predictor of positive returns, there is no strong evidence to support that sustainable funds will outperform non sustainable funds. Finally, the studies that found a positive correlation between ESG measures and financial performance and also found that indexed portfolios that include ESG criteria can outperform other indexes. And lastly, that screening for socially responsible investments leads to higher returns.

Besides the benefits that ESG investing can bring in financial terms, investors have other motivations to hold these types of assets in their portfolio. Investors are motivated to hold ESG assets because of their social preferences and those with a stronger social motivation are also willing to trade financial returns for an investment that fits their social preferences, according to a study made by Riedl and Smeets in 2017. This motivation is very important for professional investors, who can take into consideration client preferences and appreciate that financial criteria are not the only measures by which investors measure their investments.

BITA collects company climate data and metrics, as well as negative and positive screenings, offering investors the opportunity to screen portfolios, to utilize our thematic impact indexes and to build custom indexes integrating these criteria. This opens a new world of opportunities for our clients to future-proof their portfolios and positioning against long-term risk.

Sources

1. ESG and Financial Performance: https://www.stern.nyu.edu/sites/default/files/assets/documents/NYU-RAM_ESG-Paper_2021%20Rev_0.pdf

2. ESG Investing: An overview of current and past trends, performance and challenges: https://www.normanalex.com/wp-content/uploads/2021/08/ESG-Investing-An-overview-of-current-and-past-trends-performance-and-challenges.pdf

3. Environmental, Social and Governance (ESG) Investing: An evaluation of Evidence: https://www.sec.gov/comments/climate-disclosure/cll12-8895812-241292.pdf

4. ESG investing: a literature review: https://dansif.dk/wp-content/uploads/2019/01/Litterature-review-UK-Sep-2017.pdf

5. Literature Review of ESG Investment: https://www.atlantis-press.com/proceedings/ichess-22/125983135

6. Why Do Investors Hold Socially Responsible Mutual Funds?: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2318987

7. ESG Investing and Asset Returns: https://www.fraserinstitute.org/sites/default/files/ESG-myths-realities-esg-investing-and-asset-returns_0.pdf

8. ESG assets may hit $53 trillion by 2025, a third of global AUM: https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/