Geographic concentration of data centers and their future: resilience of current options and new possibilities.

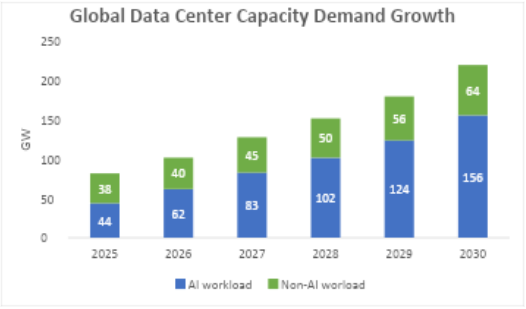

The global demand for data center capacity is expected to nearly triple by 2030, with an estimated 70% of this demand stemming from AI workloads. Mid-range scenarios project that global demand for data center capacity could rise at a CAGR of 22%, with demand increasing from 89 GW in 2025 to 219 GW in 2030.

Projections indicate that sustained growth in AI will necessitate significant investment to expand data center capacity. McKinsey & Company estimates that global investments in data centers must total approximately $6.7 trillion by 2030 in order to keep pace with the escalating demand for computing power. Of this total, $5.2 trillion is projected for data centers specifically designed to handle AI workloads.

Around this investment is a key factor to consider: the power consumption of data centers. Data centers are specialized hosts to servers, storage systems, and networking equipment, and must be accompanied by the requisite power and cooling systems necessary for their operation. In the current scenario, traditional data center clusters are facing insufficient grid supply as they seek to expand their capacity, and utilities have not been able to build out transmission infrastructure quickly enough.

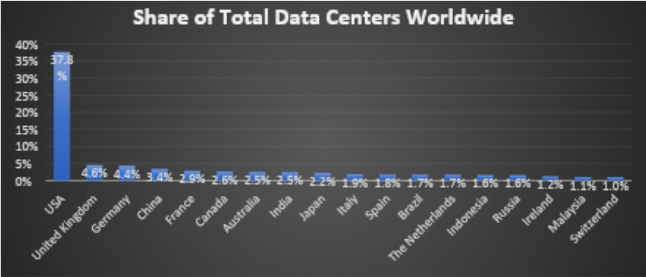

The United States is overwhelmingly the largest provider in terms of capacity, comprising 38% of the total, followed by the United Kingdom, Germany, and China, each comprising 3-5%. In terms of data center power capacity and available square footage, APAC and North America are the most significant. China's installed capacity is growing rapidly to keep pace with demand driven by the AI boom. Major Chinese internet companies are expected to invest over $70 billion in data centers in the coming year.

Data center hubs: Are existing clusters meeting data centers' capacity demand?

As of November 24, 2025, data collected by Data Center Map indicates that 18 countries account for nearly 77% of the total data centers worldwide. The United States is the predominant hub, encompassing 37.8% of the total, followed by the United Kingdom (4.6%), Germany (4.4%), and China (3.4%). In terms of data center power capacity and available square footage, the Asia Pacific and North America regions are the most significant.

To evaluate the extent to which current data center supply meets demand, occupancy rates serve as an effective indicator. Goldman Sachs projects an increase in occupancy rates from approximately 85% in 2023 to a peak of 97% in 2026, followed by a decrease to 90% by 2030, as new data centers become operational and the rapid growth driven by artificial intelligence slows. This change between 2023 and the expected rate by 2026 highlights the growing pressure on data center supply.

Regionally, the four largest markets in North America are Northern Virginia, Chicago, Atlanta, and Phoenix. Northern Virginia, recognized as the leading global market, reported a vacancy rate of 0.76%. In comparison, Phoenix exhibited a vacancy rate of 1.7%, while Chicago's rate stood at 3.1% as of the first quarter of 2025, according to CBRE Research. Atlanta, on its side, reduced its vacancy rate to 3.6% from 8.8% in Q1 2025, even though it has notably increased its capacity.

In Europe, the principal markets include London, Frankfurt, Paris, and Amsterdam, where demand continues to outstrip supply. These markets face constraints in power availability, which limit the capacity for expansion. In the first quarter of 2025, the vacancy rate in these markets was reported at 7.4% (CBRE Research 2025).

In the Asia Pacific region, Singapore recorded the lowest vacancy rate at 2%, while the regional average vacancy rate was 14% as of the first quarter of 2025, based on CBRE Research. Other important markets within this region include Tokyo, Hong Kong, Sydney, Beijing, and Shanghai.

In Latin America, key markets consist of São Paulo, Santiago, Querétaro, and Bogotá. By the first quarter of 2025, Querétaro had a vacancy rate of 0.9%, Santiago's rate was 3.4%, São Paulo reported 9.5%, while Bogotá experienced a higher vacancy rate of 21.2%. Data from the United Nations indicated that Brazil accounts for 37% of the total data centers in the region, establishing it as the largest market in Latin America.

Future of the Data Center Market Dictated by Demand for AI and Long-Term Site Selection Factors

The selection of an appropriate site for a data center is crucial, as it directly affects ownership costs through both capital expenditures for construction and operational expenses over the facility's lifespan. The key factors for consideration can be categorized into three main areas: critical infrastructure, location evaluation, and favourable policy frameworks.

Critical infrastructure comprehends the core of a data center, and embraces: reliable power, robust connectivity, and cooling solutions. Data centers require a stable, high-capacity power grid that is free from interruptions. Developers must evaluate both current and future capacity, stability, and availability of the local grid, along with electricity pricing. Also of importance are varying types of utility sources and even on-site power generation.

Artificial intelligence, particularly generative AI, is a key driver of the data centers market. From the demand perspective, the training of AI models requires immense amounts of data, necessitating power-intensive processors. AI applications utilizing graphics processing units (GPUs) consume significantly more power than traditional central processing units (CPUs). On the supply side, data center developers are investing substantial capital to construct high-capacity data centers designed to accommodate the requirements of AI workloads.

To illustrate the scale of power consumption by data centers, the International Energy Agency (IEA) measures their electricity consumption in household equivalents. In this regard, conventional data centers typically operate with a capacity of 25 MW, whereas hyperscale AI-focused data centers can exceed 100 MW, consuming as much electricity annually as 100,000 households. Additionally, the largest under-construction data center capacity considered is around 2000 MW, which would equate to the electricity consumption of two million households, while the greatest planned data center capacity considered is 5000 MW.

Estimates from 451 Research, part of S&P Global, suggest that U.S. data center power demand is forecasted to increase from approximately 61.8 GW in 2025 to 108 GW in 2028, and further to 134.4 GW by 2030, to cover IT equipment, cooling, lighting, offices, and security systems. These figures exclude enterprise-owned data centers outside of hyperscale tech giants, and represent an increase of more than double by 2030 compared to 2025. Moreover, the IEA anticipates that by the end of the decade, the United States will consume more electricity for data centers than for the production of aluminium, steel, cement, chemicals, and other energy-intensive goods combined.

The energy required for computing power within data centres presents a potential risk, which can in part be mitigated by geographic location. As of September 2025, Virginia and Texas represent the largest state-level data center power demand areas in the United States, with Virginia's data center power demand expected to grow by 30% in 2025. The former states are followed by Oregon, Arizona, Georgia, Ohio, California, Illinois, and Iowa; yet none of these states account for half of the demand seen in Virginia and Texas. Consequently, data center operators are exploring emerging markets characterized by stranded power and alternative energy generation opportunities. In the U.S., these new markets include Idaho, Louisiana, Oklahoma, and smaller cities in West Texas.

New drivers in site selection also depend on the purpose of the data center. Although low latency has been a crucial reason for data centers to locate near population centers, proximity as well as network redundancy are less relevant for AI model training. Data centers specializing in AI training may be established in remote locations where power is still abundant, such as Indiana, Iowa, and Wyoming.

Connectivity is crucial in a data center. Effective data transmission heavily relies on uninterrupted high-speed fibre-optic networks and proximity to key Internet Exchange Points (IXPs). A robust internet connection with multiple providers ensures redundancy, stability, and optimal performance of the center. IXPs allow direct connectivity between networks, reducing delivery costs.

Additional factors assessed are access to water for the vast amounts required by water cooling systems, availability of flat land, avoidance of areas prone to natural disasters or high humidity/high temperatures and lastly. Access to a skilled workforce is an important factor. And lastly, tax incentives can also affect site selection, and whether tax incentives are likely to be short-term or up-front, versus long-term.

In regard to other global regions, Moody's expects Asia Pacific capacity to more than double by 2030, achieving 40% of global data center capacity. One driver of growth in this area is data sovereignty, as several governments in the region are requiring local data storage to address privacy and security concerns. Mumbai and Seoul are surging as emerging markets, and secondary markets such as Johor and Melbourne are expanding rapidly, as major markets are facing constraints to increase data center capacity.

According to the United Nations, Latin America is projected to increase its value from USD 5-6 billion to USD 10 billion by 2029, with governments and investors spending in renewable energy to support the growth of data centers.

Despite this shift toward emerging markets, still half of the capacity under development in the United States is being built in markets with over 1 GW of installed capacity, as reported by the IEA in April. Therefore, as data center power demand outpaces grid capacity, data centers will need on-site systems such as nuclear energy resources, renewable energy solutions, battery storage, natural gas generation, and hybrid configurations to fill that gap.

Companies to Watch

Alphabet Inc., Amazon.com, Meta Platforms, and Microsoft are recognized as leading hyperscalers. Meanwhile, Nvidia stands out as the frontrunner in the industry, providing computing and networking solutions to data centers. The relevance of the data center market within the company's total revenue has been steadily increasing since 2023, when it represented approximately 55% of its revenue, escalating to 88% in 2025.

Advanced Micro Devices has also seen positive results from the data center segment, which achieved a net revenue of 12.6 billion in 2024, representing an increase of 94% compared to 2023. Furthermore, the data center segment's contribution to AMD's total revenue reached 49% in 2024, a substantial increase from 29% in 2023.

To monitor advancements in data center technology, BITA has launched two significant indices:

BITA Data Center Technology Index: This index captures the performance of key public companies that provide computing hardware, energy and electrical systems, cooling solutions, memory and storage, servers, and network infrastructure, all of which are essential for data center functioning.

BITA Computing Power Index: This index captures the performance of publicly traded companies that deliver computational resources and infrastructure required by systems and AI models to process data, perform complex calculations, and make intelligent decisions.

Additionally, BITA offers several other related indices tracking companies at the forefront of Artificial Intelligence from both an application and an infrastructure perspective:

BITA Artificial Intelligence Giants UST Index

BITA China Generative AI Select Index

BITA's Proprietary Data Team meticulously analyzes revenue streams across cutting-edge areas of all industries. Our 90 Thematic Universes (with 396 investment themes or sectors) range from finance, technology, sustainability, social impact, food, health, leisure, sports, and culture to full coverage of controversial business involvement.

References

McKinsey & Company. AI power: Expanding data center capacity to meet growing demand. October 29, 2024. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ai-power-expanding-data-center-capacity-to-meet-growing-demand

Goldman Sachs. AI to drive 165% increase in data center power demand by 2030. February 4, 2025. https://www.goldmansachs.com/insights/articles/ai-to-drive-165-increase-in-data-center-power-demand-by-2030

CBRE. Global Data Center Trends 2025. June 24, 2025. https://www.cbre.com/insights/reports/global-data-center-trends-2025

S&P Global. Data center grid-power demand to rise 22% in 2025, nearly triple by 2030. October 14, 2025.https://www.spglobal.com/commodity-insights/en/news-research/latest-news/electric-power/101425-data-center-grid-power-demand-to-rise-22-in-2025-nearly-triple-by-2030?utm_source=google&utm_medium=cpc&utm_campaign=2025_bioenergy_global_new_logos_biofuels_saf_dsa_inbound_google_ads&utm_id=701cm00000BQNx8AAH&gad_source=1&gad_campaignid=22830505619&gbraid=0AAAAADz9Xd6GZ2MaHoU7H6jIv8MTMxjaR&gclid=Cj0KCQiArOvIBhDLARIsAPwJXOZ6x0opdesknSAnCwd6qVRDJ48VWrSxG0nIo66ri3fhmXUpGyIWPlYaAhDqEALw_wcB

McKinsey & Company. The cost of compute: A $7 trillion race to scale data centers. April 28, 2025. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-cost-of-compute-a-7-trillion-dollar-race-to-scale-data-centers

Eaton. 2025 data center progress report. Digital transformation and energy management in the wake of AI. January 2025. https://www.eaton.com/content/dam/eaton/digital/brightlayer-data-centers-suite/suite-assets/white-papers/eaton-data-center-segment-report-2025-whitepaper-wp152032-en-us.pdf

Data Center Map. Worldwide Data Centers. Accessed November 24, 2025. https://www.datacentermap.com/datacenters/

BDO USA. BDO’s Strategic Guide to Data Center Site Selection. September 10, 2025. https://www.bdo.com/insights/industries/technology/strategic-guide-to-data-center-site-selection

IEA. Energy and AI. April 2025. https://iea.blob.core.windows.net/assets/601eaec9-ba91-4623-819b-4ded331ec9e8/EnergyandAI.pdf

NVIDIA. Annual Report 2025. February 26, 2025https://d18rn0p25nwr6d.cloudfront.net/CIK-0001045810/177440d5-3b32-4185-8cc8-95500a9dc783.pdf

Advanced Micro Devices. Annual Report 2024. February 5, 2025. https://ir.amd.com/financial-information/sec-filings/content/0000002488-25-000012/amd-20241228.htm

Moody’s. APAC data centers: Dispersed growth, unique challenges. August 14, 2025. https://www.moodys.com/web/en/us/creditview/blog/apac-data-centers-800bn-dollar-opportunity.html

United Nations Development Programme. Data in the Clouds, Centers on the Ground: The Role of Data Centers in LAC’s Digital Future. April 15, 2025. https://www.undp.org/latin-america/blog/data-clouds-centers-ground-role-data-centers-lacs-digital-future