Introducing: BITA Airlines and Airports Giants Index

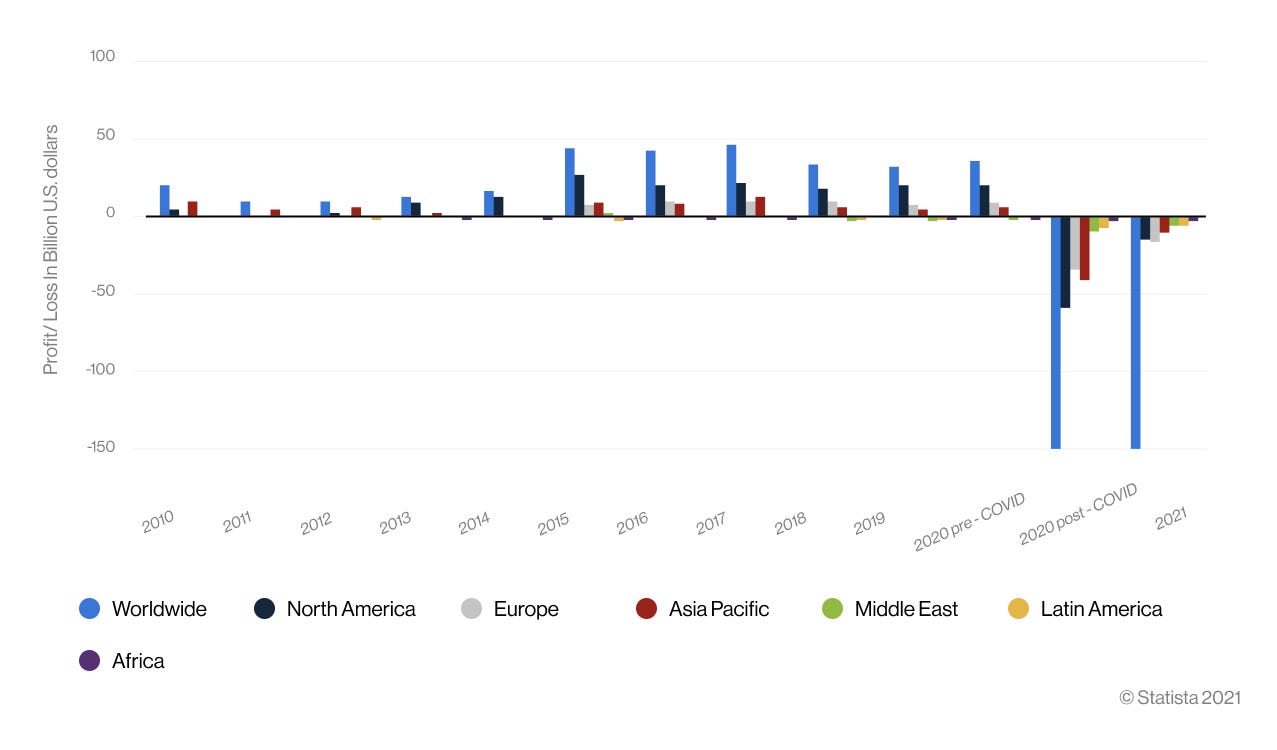

The Coronavirus pandemic has certainly proven to be a challenge for Airlines and Airports because of travel restrictions and lockdown measures established by countries across the world. In 2020, the Airlines sector worldwide accumulated approximate losses of USD 119 billion, compared to previous years of healthy profits. According to Deloitte’s report, “COVID-19 Aviation’s recovery flight plan”, in April 2020, international flights decreased by nearly 80 percent, and domestic flights decreased by 70 percent.

Despite how daunting these figures might look, this is a great opportunity for investors to target this sector before the upswing, as vaccine rollouts guarantee the return of air travel, as more people will travel when lockdowns end.

Many experts foresee a substantial rebound for this industry in the coming months, even if this recovery won’t occur immediately because of the substantial changes that our society has undergone. Travel is slowly returning to previous levels, but one must keep in mind that business travel will likely change forever due to online alternatives, and many people might not return to leisure travel. The travel sector is already going through a substantial transformation that will reshape the entire travel experience for customers and will be adapted to the ’new normal’ that we are currently experiencing.

According to Deloitte: “Lower demand and higher expectations will have a cascading impact on aviation operations across the sector. Collaboration, partnership, and even “coopetition” will play a vital part in enabling aviation organizations to achieve the operational agility needed to be as efficient as possible while protecting the health and safety of passengers and workers alike.”

Index Overview

We have been tracking the Airline and Airports sector closely, and have designed the BITA Airlines and Airports Giants Index (BNAAGI) that faithfully tracks the segment, while allowing for optimal returns.

This instrument aims to track the Gross Total Return performance of securities, listed at recognized US and Canada-based Exchanges, from companies that derive over 80% of their revenues from the operation of Airline and Airport services. The index constituents are weighted based on free-float market capitalization and rebalanced on a quarterly basis.

Since the beginning of 2021, BNAAGI has had returns of 29.30% compared to SPY’s 12.32% returns, outperforming it by 16.99%

BITA’s Airlines and Airports Giants Index is an ideal instrument for investors who seek to get exposure to the Industrials segment, particularly within Transportation and Shipping.

As of April 13th, the top ten constituents of the index included:

About BITA

At BITA, we use a transparent, straightforward, and consistent construction process that ensures true exposure to megatrends. Moreover, our state-of-the-art index development software allows us to be flexible in designing and implementing innovative passive solutions for our clients.

To learn more about BITA’s real-time data products, please visit our website at http://www.bitadata.com or contact us at info@bitadata.com.