Liquefied Natural Gas (LNG): Now More Vital Than Before

• Natural Gas (LNG) has reshaped the natural gas market, connecting consumers and suppliers across the globe.

• LNG has played a pivotal role in filling in the gap left by restricted access to the Russian market.

• Natural gas remains critical as a reliable and relatively cleaner energy solution in an era of global energy transition.

• The outlook for the industry is positive, with an increasing risk of high volatility given the expected gaps between supply and demand in the mid-term.

• Increased strategic value of LNG, alongside a positive outlook for the industry, make a strong case for passive investment.

The Paris Agreement set ambitious yet necessary goals for greenhouse gas (GHG) emission cuts. By 2030, the world must trim 43% in GHG emissions to limit global warming to 1.5°C per year, a threshold that will substantially reduce the effects of climate change.

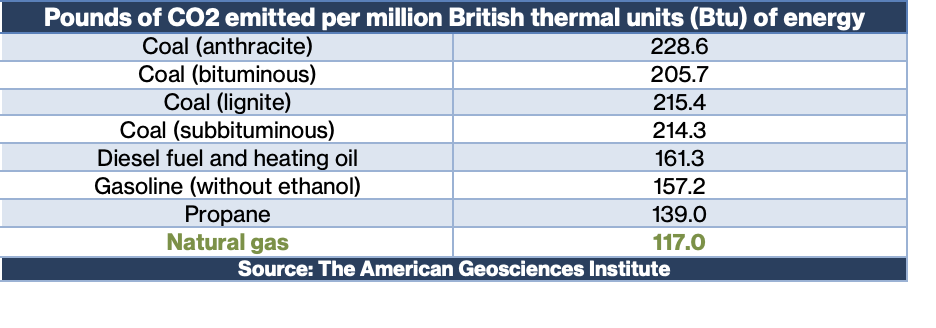

Reduction in burning of Fossil fuels is by necessity a major focus for reducing GHG emissions. Efforts are being made across the globe to phase-out coal and oil, as well as reduce use and reliance on natural gas. However, with natural gas being the lowest-emitting fossil fuel, it is a bridge fuel between coal/oil and renewable energy options. Natural gas is abundant, cheap, adaptable, and most important, relatively clean versus its fossil fuel counterparts.

Compared with other fossil fuels, natural gas emits the least amount of carbon dioxide into the air when combusted – half that of coal - making it the cleanest burning fossil fuel. Natural gas also produces fewer conventional air pollutants, like sulfur dioxide and particulates.

Natural gas is not without drawbacks, with the most notable being methane leakage during its extraction which may affect its long-term viability as an alternative fuel. Methane concentration in the atmosphere is fueling global warming, and methane leakages during oil and gas extraction are a notable contributor. Regulatory policies together with economic motivation have pushed companies to improve and minimize leakage, diminishing the negative impact of the natural gas production.

Nonetheless, while the world walks towards the energy transition, a long and complicated path, natural gas remains critical as a reliable and relatively cleaner energy solution.

In turn, Liquefied Natural Gas (LNG) has reshaped the natural gas market, connecting consumers and suppliers across the globe. The recent geopolitical conflict between Ukraine and Russia highlights the strategic importance of LNG. To reach liquid form, natural gas is cooled to -162˚C resulting in a liquid that is 1/600th of its gas volume. LNG became a viable option in the early 2000s due to technological breakthroughs which significantly reduced costs of regasification and liquefaction plants, vessels, and other supply chain processes, allowing more players to get into the market.

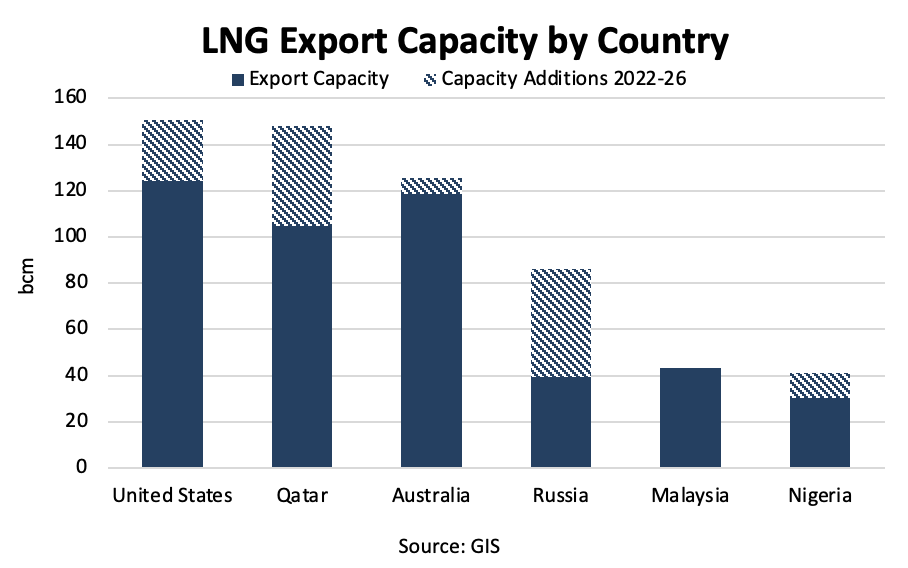

Also, the last decade saw US energy production thrive. Hydraulic fracturing and horizontal drilling unlocked vast reserves of new oil and gas resources, causing an expansion in the global gas supply, therefore influencing its international price. By July-2022, the US held the largest LNG export capacity followed by Qatar and Australia.

The shock in the natural gas supply caused by the Russian invasion of Ukraine reshaped the global market. Europe was partially isolated, given its historic reliance on the Russian and Norwegian pipeline supply. Natural Gas trade between the European countries and Russia almost completely halted after the invasion. This massive disruption could have caused a deep energetic crisis, but LNG solved the issue of traditional supply chain via point-to-point pipelines., adding flexibility and unifying the supply chain to a global one. LNG has played a pivotal role filling in the gap left by Russia as a fuel for power plants and also as a key feedstock to produce chemicals, fertilizers and hydrogen.

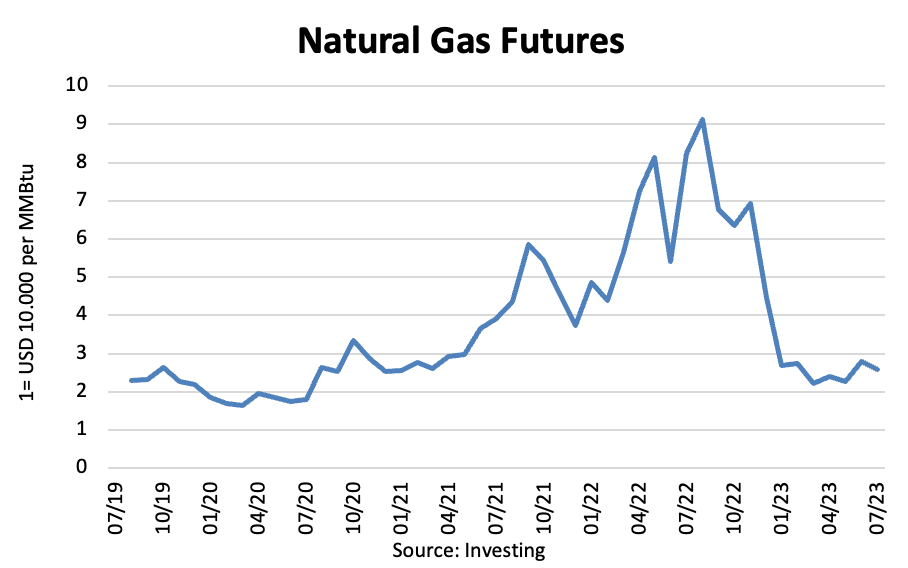

The eruption of Europe as an LNG importer destabilized the market, and prices soared to all-time records. Spot LNG prices hit USD 70.50 per million British thermal units (mmBtu) in 2022 but have dropped nearly 83% since. Global trade rose to 401.5 million tonnes (MT) in 2022, a 6.8% YoY increase driven by the surge in European demand. Pressure on the European and global gas markets has eased since the beginning of 2023 due to favorable weather conditions and policy actions.

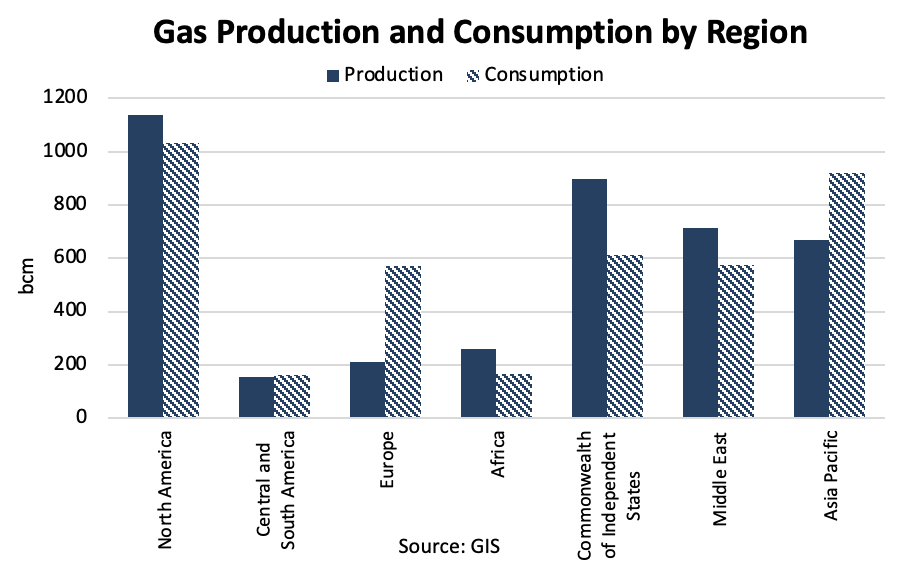

The volatility risk in the gas market persists, as the war does not seem to have an end in sight. Nonetheless, the fact that prices are already close to their 2019-2021 average is directly related to the flexibility of liquefied natural gas trade. According to GIS, from 2011 to 2021, interregional LNG trade grew more than four times as fast as pipeline trade. And in 2020, for the first time, the share of natural gas sold in liquid state surpassed pipeline trade.

The outlook for the industry remains positive, with an increasing risk of high volatility given the expected gaps between supply and demand caused by the ongoing conflict, among other factors. On the supply side, according to The Institute for Energy Economics and Financial Analysis (IEEFA), LNG production will likely stagnate, caused by relatively little new liquefaction capacity expected to be added through mid-2025. However, the slump will likely be followed by an important capacity boost, driven by new projects in the U.S. and Qatar. Analysts expect that the amount of new liquefaction capacity added in 2026 will surpass the preceding five years combined.

On the demand side, the expectation is positive since investment in regasification units has soared in several net import regions, especially in Europe. The wound left by the geopolitical tensions with his historic supplier has pushed European countries to invest heavily in LNG infrastructure. According to S&P Global, Germany (the most reliant on Russian pipeline gas) plans to build at least six floating storage and regasification units (FSRU) and three shore terminals, which will eventually replace FSRUs.

East Asian countries are among the top consumers of LNG and will keep playing a key role in the expected demand expansion in the mid-term. The 2022 price rally partially eroded demand from Japan and South Korea, and both countries are exploring plans to boost nuclear, wind, solar, and other clean alternatives to diminish the dependency on natural gas, but security concerns over nuclear production (especially in Japan) could undermine its potential as an alternative to LNG.

China is expected to provide the biggest contribution to demand expansion. Covid-19 restrictions and the subsequent slump in economic growth caused a contraction in LNG imports of 20% last year. However, 2023 has seen an expansion in China’s demand, with several firms (Wood Mackenzie, Rystad, among others) forecasting at least a 9% expansion in the current year. Mid-term projections are optimistic too, with the IEEFA expecting 60 mt of additional volume imported by 2040 (from a base measure of 81 mt in 2021).

The ability shown by the LNG industry to integrate fragmented regional gas markets into a unified global one, diminishing the risk of depending on a unique source, and the important of gas in the long-term balance energy, could poise the industry for a positive run in the mid-term.

BITA’s LNG Ecosystem thematic universe offers comprehensive coverage of this trending industry. As with each of BITA’s 80+ thematic universes, LNG Ecosystem includes companies active in every product, service and activity relating to the theme. Our data accurately measure thematic and economic exposure of a company to the LNG industry with full granulariy and transparency. BITA’s LNG Ecosystem thematic universe powersthe BITA Liquid Natural Gas Giants Index and is available to build additional indexes to support passive investment decisions.

Sources:

https://www.unep.org/news-and-stories/story/natural-gas-really-bridge-fuel-world-needs#:~:text=Where gas has a special,power plant takes much longer.

https://www.americangeosciences.org/critical-issues/faq/how-much-carbon-dioxide-produced-when-different-fuels-are-burned

https://www.nationalgeographic.com/science/article/super-potent-methane-in-atmosphere-oil-gas-drilling-ice-cores

https://www.spglobal.com/commodityinsights/en/market-insights/blogs/natural-gas/041223-how-the-russia-ukraine-war-is-turning-natural-gas-into-the-new-oil

https://www.iea.org/reports/the-role-of-gas-in-todays-energy-transitions

https://www.reuters.com/business/energy/lng-market-still-faces-elevated-risk-return-2022-conditions-igu-says-2023-07-12/#:~:text=Spot LNG prices hit a,have dropped nearly 83%25 since.

https://lnglicensing.conocophillips.com/what-we-do/about-lng/natural-gas-facts/#:~:text=Why Natural Gas is the,substances emitted when humans exhale.

https://thehill.com/opinion/energy-environment/3786649-why-natural-gas-plays-a-key-role-in-the-clean-energy-transition/

https://www.gisreportsonline.com/r/gas-markets/

https://ieefa.org/resources/global-lng-outlook-2023-27

https://www.naturalgasworld.com/japans-nuclear-power-restarts-could-hit-lng-imports-hard-gas-in-transition-103223

https://www.eia.gov/todayinenergy/detail.php?id=56680#:~:text=After becoming the world's largest,China's General Administration of Customs.

https://www.arabnews.com/node/2227411/business-economy#:~:text=China's demand is set to,Energy%2C Wood Mackenzie and ICIS.