Rising Adoption of Smart Contracts: Applications far beyond their origins in Digital Assets

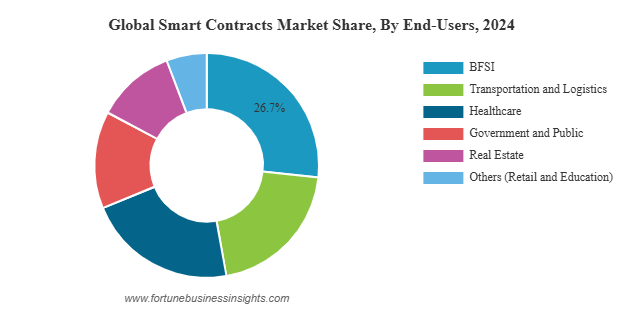

The rise of smart contracts is driven by distributed ledger technology's ability to self-execute digital agreements. At the same time, their more recent adoption across multiple sectors is facilitated by decentralized applications (DApps) and the integration of artificial intelligence (AI). Once the parameters are agreed upon, the contract automatically executes. These types of contracts help reduce uncertainty and ambiguity between parties and minimize the possibility of malicious activity. Smart contracts enhance security, reliability, scalability, and efficiency while reducing costs. However, they depend on the use of distributed ledger technology (DLT). While DLT’s early adopters were digital assets and gaming, their use is now spread across major sectors: BFSI, supply chain and logistics, healthcare, and real estate.

Current Applications and Outlook

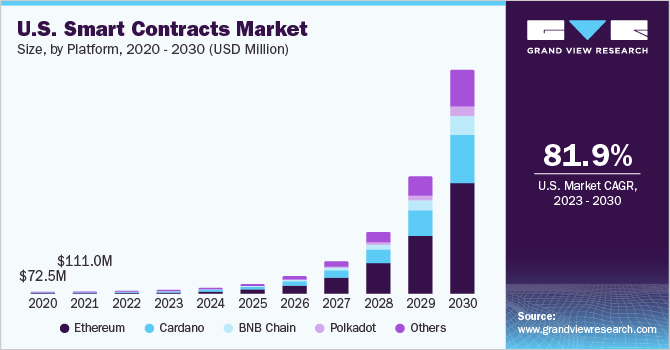

The global smart contracts market was sized at USD 684.3 million in 2022 by Grand View Research (n.d.) and is expected to grow at a compound annual growth rate (CAGR) of 82.2% from 2023 to 2030. Two-thirds of revenue share is currently controlled by large-cap companies.

DApps facilitate more and different uses of DLT and execution of smart contracts. They also encourage innovation by allowing developers to build on existing platforms and protocols, and often have open-source components. Smart contracts facilitate crossing between different blockchains, breaking down barriers between users across different blockchains, and allowing for a network effect to take place in smart contracts.

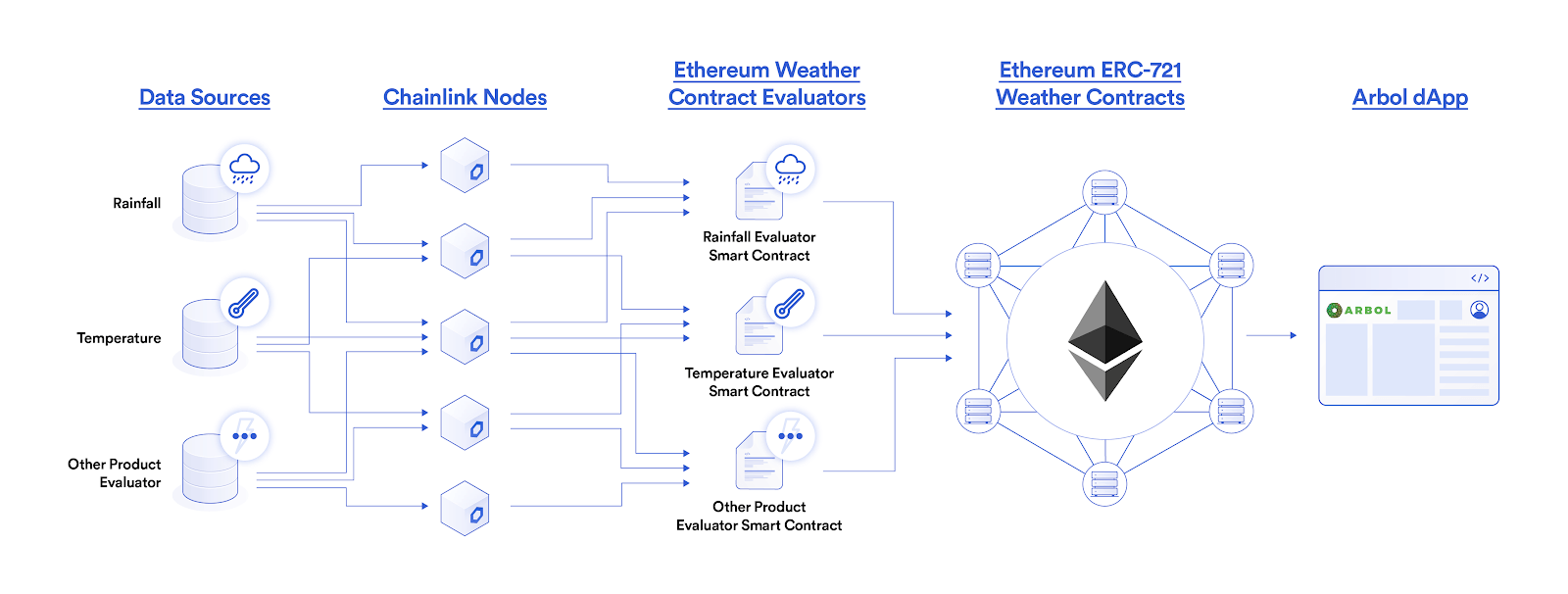

AI is now trained to operate across distribution networks, allowing for AI-powered smart contacts. Oracles play a critical role as a bridge for providing external, real-world data intelligence. AI-powered decision models can range from consensus weather forecasts to trade execution optimization.

Financial Services Sector

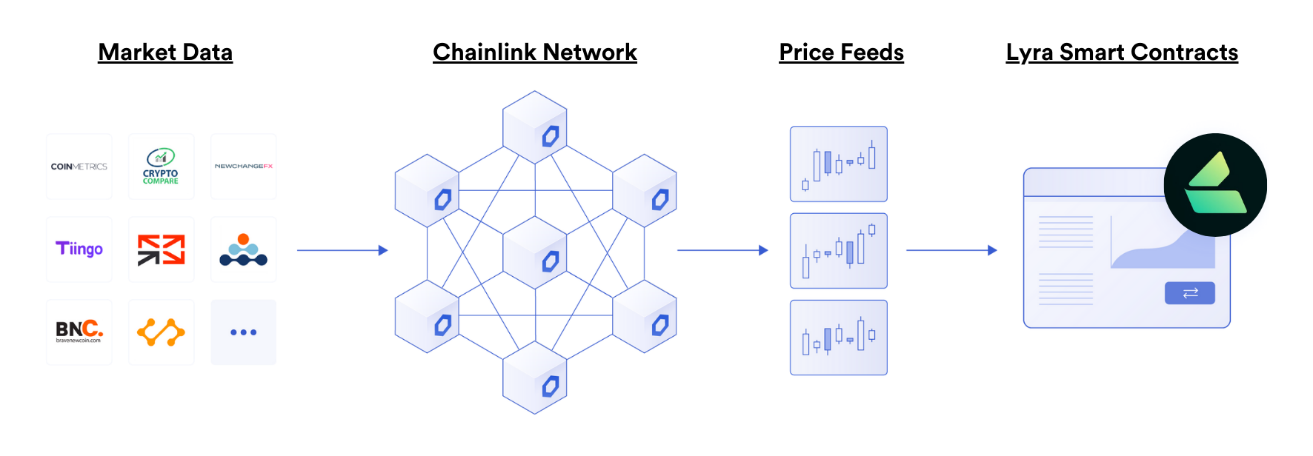

In the traditional finance sector, smart contracts powered by AI can analyze market conditions to optimize trade execution. Traditional smart contracts can automate futures solvency. With the implementation of perpetual futures contracts, a futures derivative that has no expiry date, MCDEX and Lyra enable their investors with flexibility, not binding them to acquire the underlying asset to operate in the future market, and allowing investors to enter and exit positions, with the use of off-chain data (Chainlink).

Smart Contracts are used for automated asset management with key data and the parametrization of variables. For example, Pickle Finance, which helps investors to manage capital-efficient positions, utilizes a yield maximizer that allows users to set their yield strategy and automatically rebalances their assets based on their input with the use of smart contracts (Hamilton 2023).

In insurance, smart contracts will bring automation of settlements and claims by removing human interference, lending policyholders, such as hospitals, the medical information of an individual without the need to reveal their identity.

Blockchain insurance can execute contracts based on off-chain data with trusted information, more quickly responding to situations. Key companies actively pushing the barriers in this sector are Consortium B3i and Arbol. Arbol is a smart contract-based weather coverage solution that connects to rainfall datasets from the NOOA and settles the parametric crop insurance contracts (Chainlink, 2019). Furthermore, a smart contract can make cover products far more accessible to unfavored clients, such as farmers, by protecting them from excess rainfall in their crops via access to reliable databases of the real world (Arbol, n.d.) (Figure 3).

Supply Chain and Logistics

Automation and visibility are the core benefits of smart contracting in supply chain and logistics. From order and payment processing, tracking, and settlements to inventory management and regulatory compliance, every stage of the supply chain can benefit from smart contracts. The initial investment for moving to DLT is a major hurdle and a barrier to entry. Nevertheless, the benefits over time are widely acknowledged.

Healthcare

Smart contracts allow for better patient privacy in data management and transparency. From drugs, research, and clinical trials, data and information can be managed and shared with DLT and smart contracts. And from a patient’s point of view, DLT creates a single, permanent source for patient data that can be shared between doctors, pharmacists, hospitals, and insurers.

Real Estate Sector

Traditionally, the real sector has been characterized by transactions requiring extensive paperwork and a long chain of intermediaries, generating costs and inefficiencies. As transactions have become more digital and reliant on automation, smart contracts have naturally been incorporated into the process. With the implementation of smart contracts, property transactions can be automated, secured, and simplified, as can escrow, lease agreements, and title management.

Service and Product Providers for Smart Contracts

Currently, companies and organizations, including IBM, Microsoft, Baidu, the Ethereum Foundation, and Chainlink, are enabling the production, deployment, and management of smart contracts through their solutions and platforms. As more institutions adopt and integrate Blockchain into their operations, we expect to find more innovations in the Blockchain environment.

Conclusion

Smart contracts automate numerous areas of business transactions, rendering them more dynamic and responsive to our needs. Companies in the identified sectors and areas have opportunities to stay ahead of their peers in service to clients, automation, and cost savings.

BITA’s thematic universes cover an array of promising and cutting-edge areas that are not covered by traditional sector-based indexing. BITA’s proprietary team identifies companies in the Blockchain and DLT universe that actively develop smart contract technologies. This universe envelopes promising areas within the Blockchain environment, such as Crypto Payment, Blockchain Software Development, among others. We expect to see a greater acceptance of these technologies throughout the years, alongside an encrypted environment with more complex and useful applications for a wider range of sectors in the future. Two live Bita Indexes built Bita’s Blockchain and DLT universe are:

Bita NFT and Blockchain Giants Index

Bita NFT and Blockchain Select Index

References

Arbol. (n.d.). Arbol. Retrieved from https://www.arbol.io/post/smart-contracts-and-blockchain-can-help-close-the-global-protection-gap-enable-businesses-to-build-climate-resilience

Chainlink. (2019, May 17). Chainlink. Retrieved from https://blog.chain.link/smart-contract-use-cases/

Chainlink. (2023, November 29). Chainlink. Retrieved from https://chain.link/education/smart-contracts#history-of-smart-contracts-2

Chainlink. (2024, January 12). Retrieved from https://chain.link/education/blockchain-oracles

Compendium. (2022, December 8). Retrieved from https://compendium.finance/education-resource/a-brief-history-of-smart-contracts-from-concept-to-implementation-1670264972161x626976571783759900

Dancuk, M. (2023, February 9). Retrieved from phoenixnap: https://phoenixnap.com/kb/boolean-data-type#:~:text=A%20boolean%20is%20a%20data,algebra%2C%20named%20after%20George%20Bool.

Devpost. (2020). Retrieved from https://devpost.com/software/the-open-library-project

Ethereum. (2024, 03 07). Retrieved from https://ethereum.org/en/smart-contracts/

Grand View Research. (n.d.). Retrieved from https://www.grandviewresearch.com/industry-analysis/smart-contracts-market-report

Hamilton, D. (2023, May 30). Securities.io. Retrieved from https://www.securities.io/investing-in-pickle-finance/

Hinkes, A. (s.f.). Retrieved from https://jcl.law.uiowa.edu/sites/jcl.law.uiowa.edu/files/2021-08/Hinkes_Final_Web_0.pdf

Jünemann, M., & Milkau, U. (2021, July 27). Can Code Be Law. Bird&Bird&DLT, pp. 1-13. Retrieved from https://www.twobirds.com/-/media/pdfs/news/articles/2021/junemann-milkau-2021-can-code-be-law-download.pdf?la=en&hash=D0B27FA83BFCB3FC5D27739B9F868C7BCF0AA780

Lia, R. A. (2023). ASSESSING THE POTENTIAL OF DECENTRALISED FINANCE AND BLOCKCHAIN TECHNOLOGY IN INSURANCE. Retrieved from The Geneva Association: https://www.genevaassociation.org/sites/default/files/2023-08/DeFi%20insurance_WEB.pdf

Liveplex. (2024, February 26). Slideshare. Retrieved from https://es.slideshare.net/slideshow/the-evolution-of-smart-contracts-transforming-business-processes/266506386

Lyra. (2021, August 30). Retrieved from https://blog.lyra.finance/lyra-integrates-chainlink-price-feeds/

Mik, E. (2017, 10). Smart Contracts: Terminology, Technical Limitations and Real World Complexity. Research Collection School Of Law., 9, pp. 269-300. Retrieved from https://core.ac.uk/download/pdf/132698353.pdf

Pickle Finance. (2022, March 28). Medium. Retrieved from https://picklefinance.medium.com/pickle-finance-univ3-jars-powered-by-chainlink-keepers-8ce1756a2497

Raskin, M. (2017). ILSA. Retrieved from https://georgetownlawtechreview.org/wp-content/uploads/2017/05/Raskin-1-GEO.-L.-TECH.-REV.-305-.pdf

Skadden. (n. d.). Retrieved from https://www.skadden.com/-/media/files/publications/2018/05/cybersecurity_smartcontracts_050818.pdf

SoluLab. (2023, December 6). Slideshare. Retrieved from https://es.slideshare.net/slideshow/smart-contracts-and-their-role-in-blockchain-developmentpdf/264349124?_gl=1*scyeta*_gcl_au*MTc2NTU5OTMxNS4xNzE3NDM3MTA5

Szabo, N. (1994). Retrieved from https://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart.contracts.html

Verstraete, M. (2019). The Stakes of Smart Contracts. Loyola University Chicago Law Journal, 50(3), pp. 743-795. Retrieved from https://lawecommons.luc.edu/cgi/viewcontent.cgi?article=2692&context=luclj

Wikipedia. (n.d.). Retrieved from https://en.wikipedia.org/wiki/Scripting_language

Wikipedia. (n.d.). Retrieved from https://en.wiktionary.org/wiki/ex_post

Zhang, Z., Zhang, B., Xu, W., & Lin, Z. (n.d.). Retrieved from https://www.cs.purdue.edu/homes/zhan3299/res/ICSE23.pdf