The Cannabis Market Revival: What Investors Need to Know

Key Findings

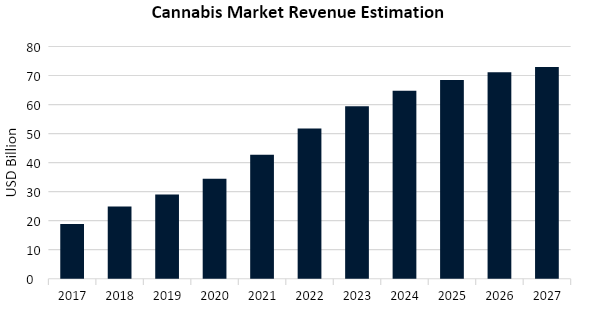

- Market growth: The global cannabis market is projected to increase from USD 34.4 billion in 2020 to USD 65 billion in 2024, with growth expected to double over the next decade.

- Investment landscape: North America remains the leading investment market, but emerging markets in Europe and Latin America offer exciting possibilities.

- Economic impact: The industry promises substantial job creation, tax revenue generation, and overall economic stimulation.

- Market Segmentation: The medical and recreational market segments allow investors to focus their investment approach.

For many years, the global conversation surrounding cannabis use has been marked by intense debate and controversy. However, recent decades have witnessed growing public support for legalization efforts in numerous countries.

This growing support is reflected in the significant rise in cannabis users. According to the New Frontier's 2021 Global Cannabis Report, the number of cannabis consumers globally jumped by 58% from 2010, reaching an estimated 268 million in 2020.[1]

This trend shows no signs of slowing down, as evidenced by countries like Germany and the US passing cannabis legalization and reclassification measures, opening doors for potential investors.

Behind the Cannabis Boom

The gradual shift in social perception towards cannabis is a major driver of the market's growth. As countries increasingly legalize its consumption, the stigma surrounding cannabis weakens. This growing societal acceptance fuels new consumer demand for cannabis-related products.

Beyond social acceptance, the economic potential of cannabis is based on the following:

-

Economic benefits: A legal and regulated cannabis market can lead to:

- Job creation

- Increased business opportunities

- New tax revenue streams

-

Health and well-being benefits:

- Safe and controlled access to cannabis with known medicinal and therapeutic properties.

- Opportunities for broader scientific research and development of more effective medicinal products.

Investment Landscape

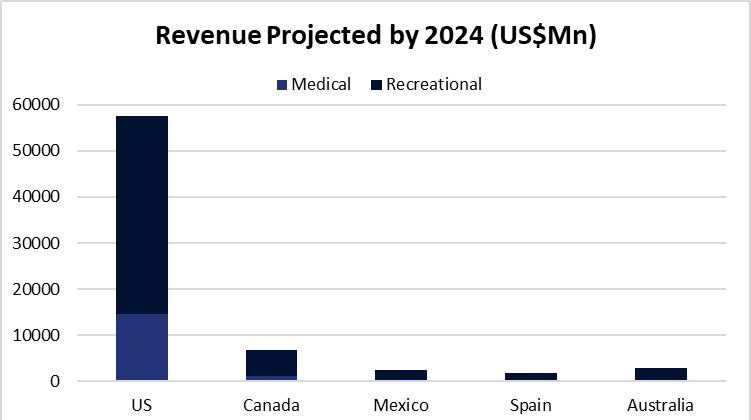

Driven by the ongoing legalization movement, Statista projects the global cannabis market to reach a staggering USD 64.7 billion in 2024.[2] Notably, medical cannabis is expected to be the dominant force, accounting for over half of the market and driving legalization efforts worldwide.

Dominant markets for legal cannabis sales include the United States, Canada, Mexico, Australia, and Spain. However, the primary uses of cannabis vary significantly across these regions.

- Medical use reigns supreme in the United States, with patients seeking relief from chronic pain, anxiety, and epilepsy.

- Canada, since legalizing in 2018, leans more towards recreational uses, though medical applications remain recognized.

- Australia prioritizes medicinal purposes within its legal framework, emphasizing strict government regulation and quality control.

- Mexico's recent legalization targets adult-use consumption, aiming to curb violence associated with the illegal drug trade.

- Spain operates under a unique system of private cannabis clubs. Members cultivate and share cannabis for personal use, with medical applications playing a less prominent role.

Market Segmentation

The global cannabis market can be divided into two primary segments:

- Medical cannabis: This segment focuses on products derived from marijuana or cannabis plants used to alleviate symptoms of various medical conditions. These conditions include Alzheimer's disease, Crohn's disease, epilepsy, seizures, and glaucoma. Notably, medical cannabis is projected to account for roughly 60% of the total cannabis market in 2024.

- Recreational cannabis: In contrast, the recreational segment includes products used for enjoyment, not health benefits. These products typically contain higher concentrations of THC, the psychoactive compound in cannabis. Examples include dried flowers, oils, edibles, tinctures, and topicals.

Bolstered by projections of significant growth across both segments, countries worldwide are increasingly relaxing cannabis regulations, transitioning towards legal and regulated markets. This shift is expected to significantly boost the cannabis market in the short and medium term. According to Statista, the total market revenue is projected to grow at an annual rate (CAGR) of 5.29%, reaching a staggering US$73 billion by 2027.[3]

Germany's Cannabis Act

On April 1st, 2024, Germany took a historic step forward with the implementation of the Cannabis Act (Cannabisgesetz, CanG).[4] This legislation aims to:

- Facilitate responsible cannabis use for adults.

- Minimize black market activity.

- Enhance protection of children and young people.

The law allows adults over 18 to possess a significant amount of cannabis and consume it in designated public spaces. This move has been celebrated as a milestone for cannabis reform in Europe, potentially paving the way for similar legislation in countries like Switzerland and the Czech Republic.[5] Germany joins a small but growing list of European nations embracing recreational cannabis legalization. Malta and Luxembourg became the first in Europe to do so in 2021, and Germany's new law is seen as a potential tipping point for broader European cannabis reform.[6]

North American Dominance

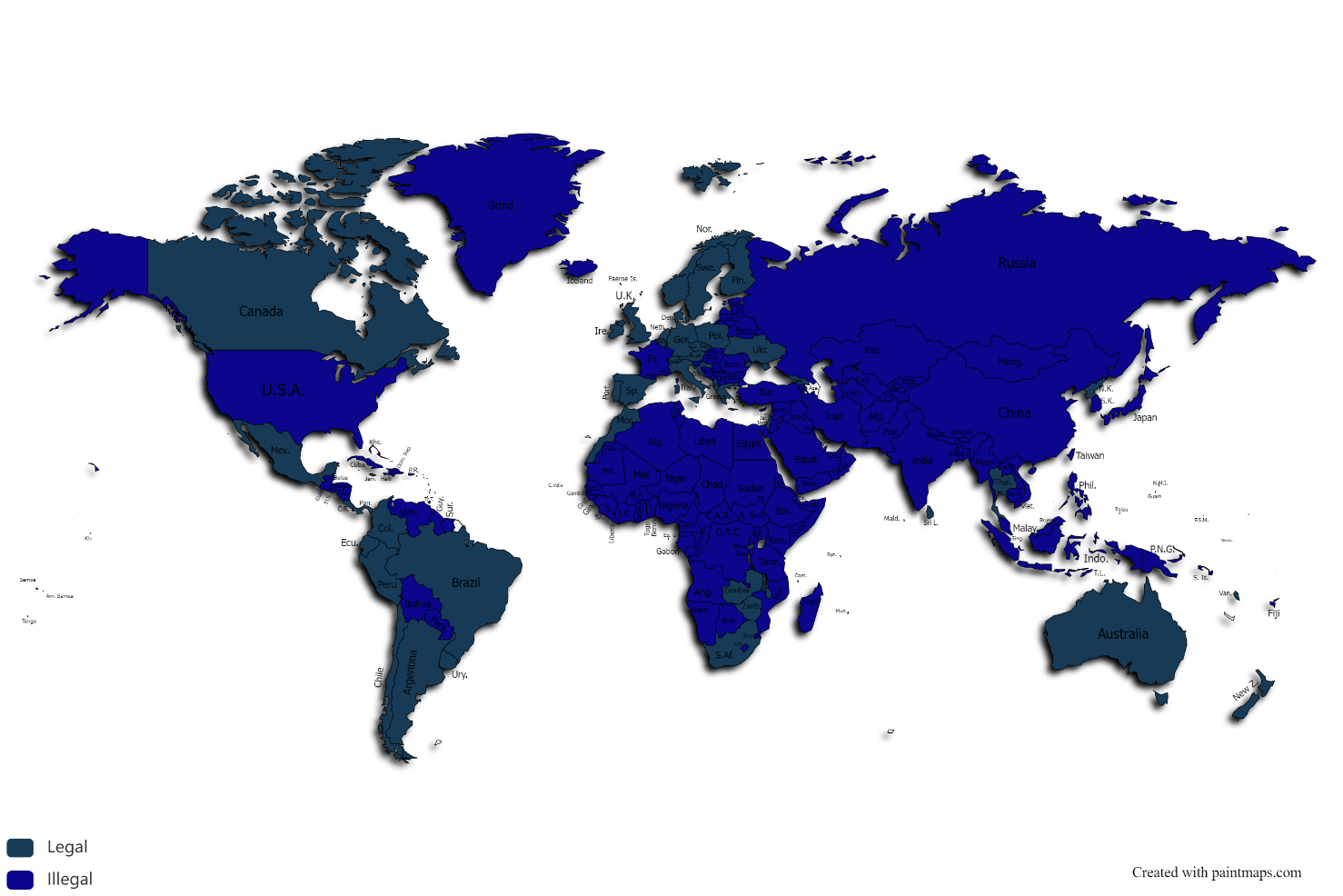

The United States and Canada have been at the forefront of cannabis legalization, influencing how governments worldwide approach this issue. According to New Frontier Data, only nine countries, alongside 24 states and three territories in the US, have legalized recreational cannabis use. Medical cannabis enjoys broader acceptance, with legalization in 49 countries and 38 states with four territories within the US.

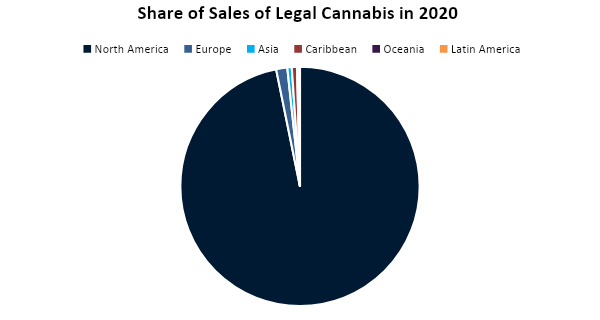

As of 2020, this region remains the undisputed leader in the global cannabis market, accounting for a staggering 97% of legal cannabis sales.

North America's overwhelming share of legal cannabis sales stems from its dual role as the world's leading exporter and the primary market for cannabis products.[7] This dominance can be attributed to several factors:

- Favorable regulations: Supportive legal frameworks have fostered growth.

- Access to capital: Investment opportunities attract funding for cannabis businesses.

- Large consumer base: A significant population fuels demand for cannabis products.

Canada's legalization of recreational cannabis in October 2018 serves as a prime example. This move allowed adults to possess up to 30 grams and cultivate four plants at home.[8] Consequently, the industry's size became directly measurable, contributing roughly 0.5% to the Canadian economy. This rapid shift is evident in legal cannabis consumption skyrocketing from 22% in late 2018 to over 70% by the first half of 2023.

While some US states possess over a decade of experience with legalized recreational cannabis, the market faces a significant challenge: lack of uniformity in regulations.[9] Several states have legalized the recreational and/or medicinal use of cannabis.

However, the federal government classifies cannabis as a Schedule I controlled substance, the most restrictive category, meaning it's illegal nationwide. This discrepancy creates a web of uncertainty for businesses and consumers. The potential for legal repercussions due to the clash between state and federal laws remains a constant concern.

Despite these federal hurdles, recent developments paint a positive outlook for the cannabis industry. Currently, marijuana shares a classification with dangerous drugs like heroin and LSD (Schedule I). However, the Drug Enforcement Administration (DEA) recently proposed a reclassification, potentially moving cannabis to Schedule III.[10] This would place it alongside less restricted drugs like ketamine and Tylenol with codeine.

The potential reclassification, combined with the growing number of states legalizing cannabis, further fuels optimism for the industry's future. Many expect a wave of deregulation to follow the DEA's possible decision.

Conclusion

The global cannabis market is poised for explosive growth. Sales are projected to skyrocket from USD 34.4 billion in 2020 to a staggering USD 65 billion in 2024, and analysts expect this trend to double over the next decade.

This burgeoning market presents a wealth of opportunities for investors worldwide. North America remains the primary investment hub, but emerging markets in Europe and Latin America offer exciting possibilities. The industry's potential is multifaceted, promising substantial job creation, tax revenue generation, and overall economic stimulation.

Furthermore, the market's clear division between medical and recreational segments allows investors to tailor their strategies. As the cannabis industry continues its dynamic evolution, it holds the potential to unlock a vast array of investment opportunities for forward-thinking individuals around the globe.

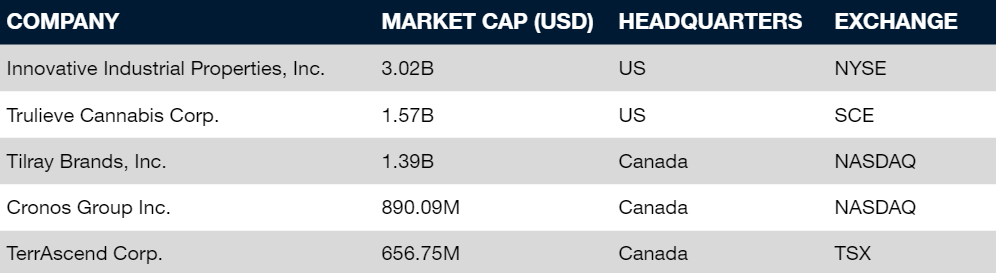

BITA's Cannabis Universe tracks a significant portion of the industry, currently encompassing 225 companies. Notably, 140 of these companies derive over 50% of their revenue from cannabis products in the current financial year.

As attitudes shift, cannabis is transforming from a controversial topic into a promising investment avenue. Favorable market conditions, coupled with forecasts of industry growth and ongoing legalization efforts, present a compelling opportunity for investors.

BITA offers the Global Cannabis Giants Index to enable investors to capture the gross total return performance of the 20 largest publicly traded companies with significant exposure to the cannabis industry's revenue stream.

BITA's proprietary data team specializes in uncovering and analyzing revenue streams of companies poised for growth. We go beyond traditional sectors, offering insights into over 90 unique universes. These universes encompass emerging industries and sub-industries across a broad spectrum including finance, technology, sustainability and social impact, food and health, leisure, sports and culture, as well as universes focused on controversial business involvement. Bita's data extends beyond financial metrics, incorporating ESG factors like emissions, waste, and Net Zero commitments.

Lange, T., 2022. “With 209 million Cannabis Users Worldwide, UN Drug Report Delves Into Legalization Impacts.” ↩︎

Statista, 2024. ↩︎

Statista, 2024. ↩︎

Library of Congress, 2024. “Germany: New Cannabis Act Enters into Force.” ↩︎

Stevens, B., 2024. “Germany’s Predicted Medical Cannabis Boom Is in Full Swing Following Passage of CanG.” ↩︎

Colli, M., 2023. “Luxembourg Legalizes Cannabis.” ↩︎

Prohibition Partners, 2019. ↩︎

Alberta Treasury Board and Finance Ministry, 2024. ↩︎

Flowhub, 2023. ↩︎

Harris, H., 2024. ↩︎

References

Brown, J., Cohen, E., & Felix, A. (2023) Economic Benefits and Social Costs of Legalizing Recreational Marijuana. https://www.kansascityfed.org/Research%20Working%20Papers/documents/9825/rwp23-10browncohenfelix.pdf

Cannabis legalization in Canada. https://www.alberta.ca/cannabis-legalization-in-canada#:~:text=The%20Government%20of%20Canada%20legalized,four%20cannabis%20plants%20per%20household

CDC (2024) Cannabis Facts and Stats. https://www.cdc.gov/cannabis/data-research/facts-stats/index.html

Jhonston, M. (2023) Biggest Challenges for the Cannabis Industry in 2024. https://www.investopedia.com/biggest-challenges-for-the-cannabis-industry-in-2019-4583874

Colli, M. (2023) Luxembourg Legalizes Cannabis. https://www.cannabissciencetech.com/view/luxembourg-legalizes-cannabis

Flowhub (2023) How the industry is performing and where it's headed. https://flowhub.com/cannabis-industry-statistics

Harris, H. (2024) The DEA plans to reclassify cannabis. What does that mean for local dispensaries? https://www.theguardian.com/society/article/2024/jun/08/dea-cannabis-reclassification-dispensaries

IceMiller. (2024) Will 2024 Be the Year the U.S. Finally Federally Legalizes Cannabis? A Look Back to 2023 and What’s Coming in 2024. https://www.icemiller.com/thought-leadership/will-2024-be-the-year-the-u-s-finally-federally-legalizes-cannabis-a-look-back-to-2023-and-whats-coming-in-2024

Krishna, M. (2023) The Economic Benefits of Legalizing Marijuana. https://www.investopedia.com/articles/insights/110916/economic-benefits-legalizing-weed.asp#:~:text=One%20motivation%20for%20legalization%20is,incentives%20to%20push%20for%20legalization

Lange, T. (2022) With 209 million Cannabis Users Worldwide, UN Drug Report Delves Into Legalization Impacts. https://www.cannabisbusinesstimes.com/news/un-world-drug-report-2022-trends-marijuana-209-million-users/#:~:text=Highlighted%20in%20the%20booklet%20on,170%20million%20people%20in%202010.

Library of Congress. (2024)“Germany: New Cannabis Act Enters into Force”https://www.loc.gov/item/global-legal-monitor/2024-04-18/germany-new-cannabis-act-enters-into-force/#:~:text=On%20April%201%2C%202024%2C%20the,Act%20(Bet%C3%A4ubungsmittelgesetz%2C%20BtMG).

Marshall, L. (2022) A decade after legalizing cannabis in Colorado, here’s what we’ve learned. https://www.colorado.edu/today/2022/11/04/decade-after-legalizing-cannabis-colorado-heres-what-weve-learned

Miletic, J. (2023) Top 20 Countries With The Highest Weed Consumption. https://finance.yahoo.com/news/top-20-countries-highest-weed-143742814.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAGt5Zh7w9bPiGr-Hke63XewrahzKLrqU-SlpfGHDQwKsMFCHlja6Ra2-AHzP2BTKPSKVgo7Mnk_-quANkobtunPZf2Uh_TaMoRwaaOMqksOdqFqbmmmd_KtYwc7nCs01vX5D5JBhBHLQ0oz-0gG3k6-HjM6TsQM0YxeZa9n-Njwc

New Frontier Data (2021) The Global Cannabis Report: Growth & Trends Through 2025. https://f.hubspotusercontent10.net/hubfs/3324860/Reports/NFD-GlobalCannabisReport.pdf

Prohibition Partners (2019) The Global Cannabis Report. https://24914560.fs1.hubspotusercontent-eu1.net/hubfs/24914560/PP%20Reports%20for%20Report%20Automations/Prohibition%20Partners%20-%20The%20Global%20Cannabis%20Report.pdf?utm_medium=email&_hsenc=p2ANqtz-86hiAXpYdENVz4AiAIwo1iWeFSwBs2W0S-LEUc4O45WuqXZn3zeT1bffX4O0bUMVsQK0NrM-IfhXDUs3DbXelxarNWEA&_hsmi=58646784&utm_content=58646784&utm_source=hs_automation

Saeedy, A. (2024) The Big Problem for Marijuana Companies? What to Do With All That Cash. https://www.wsj.com/finance/banking/the-big-problem-for-marijuana-companies-what-to-do-with-all-that-cash-09d81fc3

Statista (2024). Cannabis Worldwide. https://www.statista.com/outlook/hmo/cannabis/worldwide

Statistics Canada (2023) Research to Insights: Cannabis in Canada. https://www150.statcan.gc.ca/n1/en/pub/11-631-x/11-631-x2023006-eng.pdf?st=xiJ4EORD

Stevens, B. (2024) Germany’s Predicted Medical Cannabis Boom Is in Full Swing Following Passage of CanG. https://businessofcannabis.com/germanys-predicted-medical-cannabis-boom-is-in-full-swing-following-passage-of-cang/

Wikipedia. (2024) Legality of Cannabis. https://en.wikipedia.org/wiki/Legality_of_cannabis