The Lithium Industry: A Beneficiary of the Electric Vehicle Boom and the Energy Transition

Energy transition is imprinted deep inside the minds of consumers, investors, companies, and governments. Mid and long-term decisions are being made on a sustainable, fossil fuel-free framework. It is a challenging process, and the reluctance of some industrial sectors and energy producers makes everything trickier and slower. However, progress in several areas has been reached, and authorities seem convinced to use their coercive power to shift gears and speed up the process.

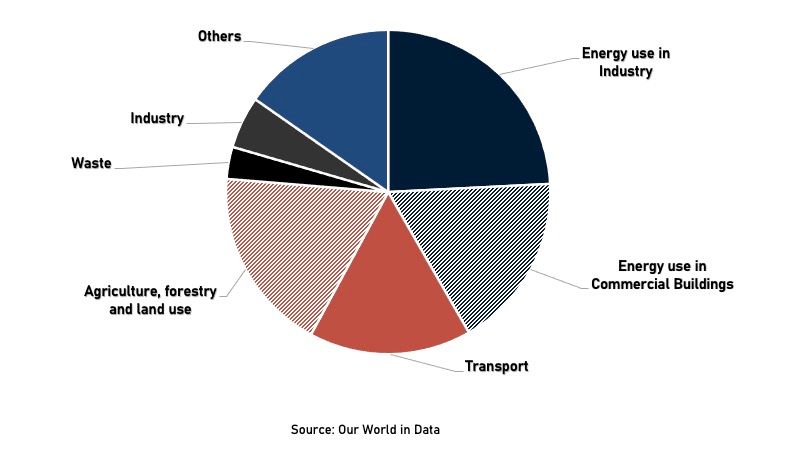

All energy and land-use systems that intervene in CO2 emission, including commercial buildings, industry, transport, construction, agriculture, waste, and forestry, will be subject to structural changes. Contrary to the common perception, the transport sector is not the main contributor to greenhouse gas (GHG) emissions, but it is among the top three. According to Our World in Data, energy used in industry and buildings are the top two contributors, accounting for 24.2% and 17.5%, respectively, with the transport sector in third place with a 16.2% share of GHG emissions measured in 2020.

Global greenhouse gas emissions by sector

Nevertheless, focus has recently centered on the mobility industry’s necessary transition. Over a century of advances around fuel-powered vehicles, the lobbying power amassed by carmakers and the fossil fuel industries (especially the latter), plus the consumer preferences for fuel-powered vehicles have long been roadblocks to the goal.

However, a new shift is shaking well-established supply chains and transforming the auto component market. The electric vehicle (EV) has risen to be the best alternative to curb the GHG emission related to the mobility segment. Carmakers have directed a share of their investment to develop electric vehicle alternatives. Nonetheless, consumers are hard to convince to switch from internal combustion engines (ICE) to EVs. Concerns around reliability, range, and more relevant, affordability, have limited consumers' interest.

Global EV sales are soaring, but they still represent a small fraction of the market. A survey conducted by CarsGuru revealed that in the USA, in 2022, 22% of new car buyers expressed interest in an EV, but only 5% bought one. 76% of the vehicle sales in 2022 were ICE, 13% hybrid, 6% diesel, and the previously mentioned 5% in EV. Nonetheless, the survey did provide a revealing insight, 60% of American car owners plan to own an electric car in the next ten years.

The EV alternative has had more impact in China and Western Europe. According to Wood Mckenzie, one of every five new cars sold is powered by electrical engines. However, the energy transition seems not to be advancing fast enough, and authorities have decided to take a more aggressive approach. In 2021, US President Joe Biden set a 50% target on EV Sales Share for 2030. Some states, such as New York and California, took even harder action in 2022 by banning ICE's new vehicle sales by 2035.

The last boost (and a big one) to the automotive industry's net-zero transitions comes from the European Union (EU) parliament. By February 14, the EU lawmakers passed a bill to ban the sale of new ICE cars in the European block from 2035. The law also raised to 55% (from 37.5%) the cut in CO2 emissions from new cars sold from 2030 versus 2021 levels.

The European Commission also unveiled a plan to replace buses with zero-emission alternatives by 2030 and diminish emissions from new trucks sold from 2040 by 90%. It is a large-scale plan that has set a clear timeframe for the 27-countries group.

The ICE market behavior has a direct impact on the petrol market dynamics. The EV alternative is no different, with the electricity and batteries supply as the key beneficiaries of an EV boom. However, the optimism around those industries is more connected to the concerns about their capacity to keep up with the growing need for electricity and battery supply. One particular industry has started to see the benefits of the transition, and producers and investors are reacting to the new developments: the Lithium Industry.

The lithium carbonate prices have soared since early 2021 amid the acceleration of the energy transition process and the economic reactivation post the Covid-19 crisis. The bullish sentiment changed abruptly by the end of 2022, with the concerns around a global economic slowdown outlook for 2023 undermining the demand for the metal. Despite the persistent negative trend in 2023, the lithium carbonate price is still at historic high levels, and the expectations for its medium and long-term outlook just got improved by the EU's new bill.

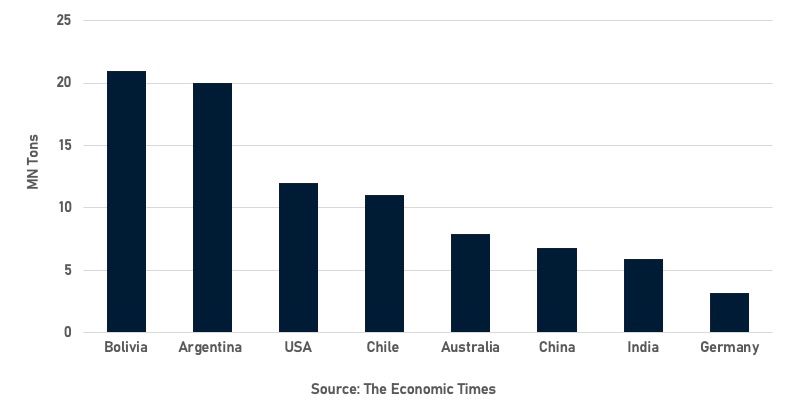

As with other mining commodities, the largest reserves are located in emerging markets such as Chile, Argentina, Bolivia, Zimbabwe, and Namibia. However, given the technological barrier needed to extract and refine the metal, only Chile figures among the top producers globally.

Lithium reserves by country

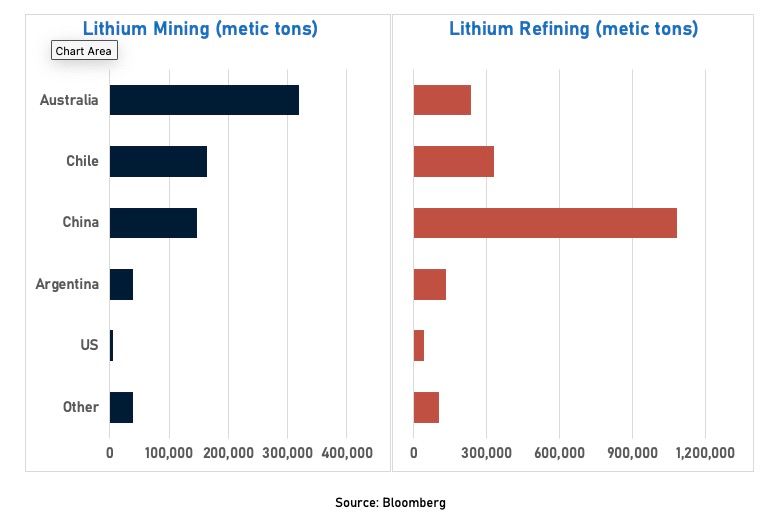

According to Bloomberg, the forecast for 2025 puts Australia as the main producer, followed by Chile and China, with Australia accounting for almost 45% of the global supply. Regarding lithium refining capacity by country, China is projected to represent 56% of the total global installed capacity, followed (by a far) by Chile and Australia.

Projected 2025 mining production and refining capacity by country

The opportunity window is wide open for resource-rich emerging markets. Zimbabwe and Namibia are making efforts to expand their production and impose restrictions on raw materials exports to stimulate investment in refining capacity. Argentina is also focused on developing its lithium mining industries. According to JPMorgan, the South American country will become the third largest producer by 2035 with 13% of the global output, the same as the entire African continent. The production is expected to grow more than 1.000% over eight years, reaching 487.000 tons.

Despite holding the largest reserves, Bolivia's irruption in the lithium market has been a disappointment. The ruling party often used lithium reserves as a political flag, but authorities have failed to develop by itself or a joint venture the metal production. Recently, the state-own enterprise Yacimientos de Litio Bolivianos announced an agreement with a group of Chinese firms, to construct two plants capable of producing 25,000 metric tons of lithium carbonate annually. However, the outlook puts them far behind their regional counterparts, leaving the country as the disappointment of the lithium triangle.

Last year, Mexican President Andres Manuel Lopez Obrador passed a bill creating a state-own company responsible for managing the exploration, mining exploitation, and refining of lithium throughout the national territory of Mexico. The controversial movement has changed the game rules, and now private players must seek to agree on joint ventures to keep operating in the country. Active participation from state-own companies in mining industries is nothing new, especially in emerging markets, but adds a layer of uncertainty.

The movement is being exploited by populist politicians to promote similar actions in Argentina. The leftist government presence in many emerging markets increases the risk of such controversial policies. Nonetheless, the time has arrived for new players to take part in the growing lithium market cake, and private capital (as always) will play a key role regardless of the authorities' political orientation.

References

https://ourworldindata.org/emissions-by-sector

https://www.woodmac.com/news/opinion/evs-the-biggest-lever-in-driving-the-energy-transition/

https://www.reuters.com/world/europe/eu-phase-out-fossil-fuel-cars-unreasonable-italy-pm-2022-12-29/

https://www.globaltimes.cn/page/202302/1285508.shtml