Transforming Industries: The Rise of Smart Contracts

Smart contracts are revolutionizing industries reliant on traditional agreements using blockchain technology. These digital agreements automatically execute when predetermined conditions are met. Grand View Research predicts a staggering 82.2% compound annual growth rate (CAGR) by 2030 for the global smart contracts market, which stood at USD 684.3 million in 2022. This surge is fueled by companies embracing the following advantages:

- Automated workflows: Automation helps reduce fraud risk and eliminate ambiguity.

- Increased scalability: Streamlined processes and reduced friction allow companies to handle increased volume with ease.

- Cost reduction: Smart contracts can lower transaction costs and boost profits.

- Competitive edge: Early adoption positions companies to capitalize on new business models and revenue streams.

While large-cap companies currently dominate with a two-thirds market share, investment opportunities remain open.

From Code to Blockchain

Since Vitalik Buterin set forth the Blockchain 2.0 era in 2015 with the creation of Ethereum, the concept of “Smart Contracts” has gained significant traction. The groundwork for smart contracts, however, was laid in 1994, when cryptographer Szabo first created this technology to mitigate malicious and accidental breaches in agreements.

Nearly two decades later, Szabo’s concept became a reality and has seen rapid development. Initially, smart contracts were written exclusively on the Ethereum blockchain with Solidity. Today, they are also supported by programming languages such as Rust and Move. This expansion extends beyond Ethereum, with platforms with like Solana, Cardano, and Bitcoin[1] offering smart contract functionality[2].

This broader functionality has paved the way for a new wave of innovation, envisioned by Buterin. He foresaw various sets of decentralized ventures that could originate from the creation of smart contracts, such as Decentralized Applications (Dapps), Decentralized Organizations (DOs), and Decentralized Autonomous Organizations (DAO).[3]

One of these concepts, Decentralized Autonomous Organizations (DAOs),[4] has already been successfully implemented. Enthusiasm for this first example amounted to 150 million dollars in the corresponding cryptocurrency in the first few weeks of the project.[5]

Industry Outlook

Insurance

Smart contracts can automate settlements and claims, removing human error and streamlining the process. This technology can also grant policyholders, like hospitals, access to an individual's medical information without revealing their identity, potentially reducing discrimination based on race or gender.

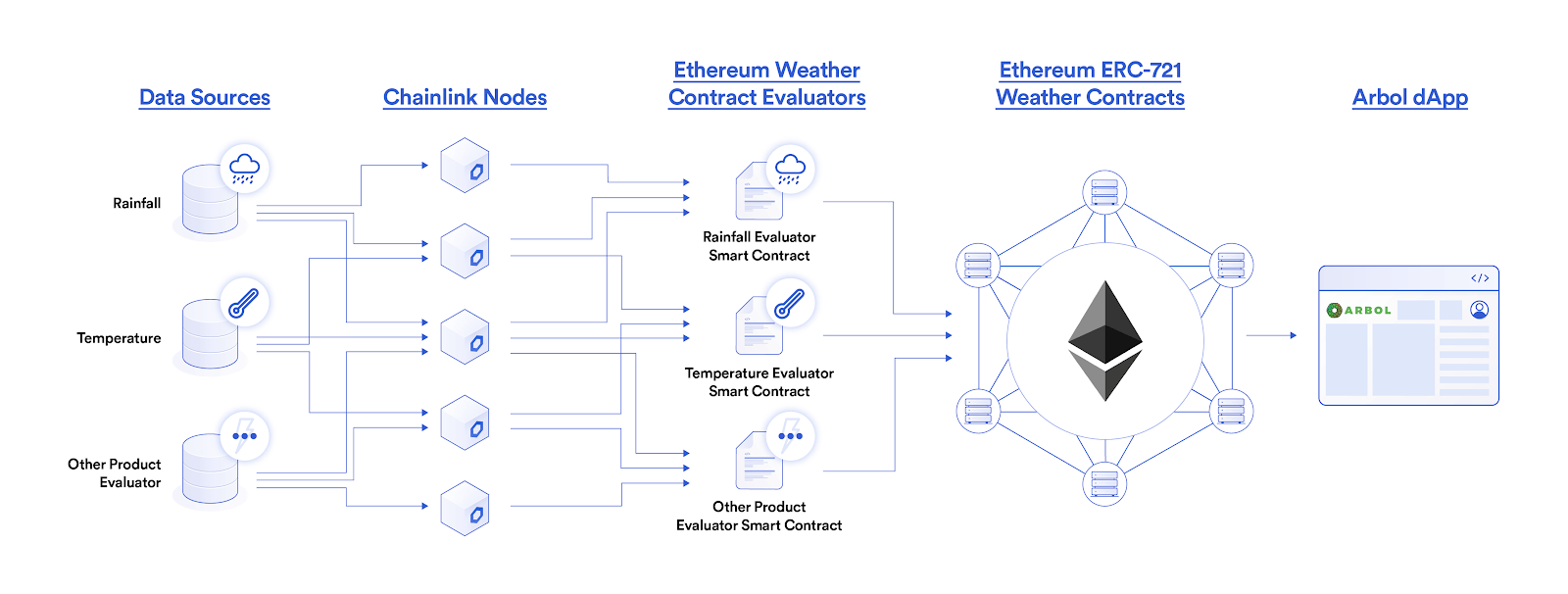

Blockchain insurance allows for quicker responses to situations by executing contracts based on trusted, off-chain data.[6] Leading companies like Consortium B3i and Arbol are pushing the boundaries in this area. Arbol, for example, is a smart contract-based weather coverage solution that utilizes rainfall data from the National Oceanic and Atmospheric Administration (NOOA) to settle parametric crop insurance contracts automatically.[7] Additionally, smart contracts can make insurance products more accessible to traditionally underserved clients, such as farmers. By leveraging reliable real-world data sources, these contracts can protect farmers from financial losses due to excessive rainfall.[8]

Financial Services

The traditional finance sector can also benefit from smart contracts in the following areas:

- Perpetual futures contracts: Platforms like MCDEX and Lyra leverage smart contracts to offer perpetual futures contracts. These derivatives have no expiry date, giving investors flexibility and allowing them to enter and exit positions freely. Additionally, they utilize off-chain data for settlements.[9]

- Automated asset management: Smart contracts can automate asset management based on key data and predefined parameters. Pickle Finance as an example, helps investors to manage capital-efficient positions.[10] This platform acts as a yield maximizer, allowing users to set their desired yield strategy and automatically rebalance their assets using smart contracts. This minimizes human error and optimizes returns.[11]

- Enhanced staking: Staking, a common requirement in blockchain protocols, might also be impacted by the introduction of smart contracts. AdEx utilizes Chainlink smart contracts to automate the process of slashing or staking collateral based on whether a node meets performance requirements.[12] This approach strengthens network security and reduces overall risk.

Gaming and NFT

Smart contracts are already being used in blockchain-based games to ensure transparency. PoolTogether, for example, is a game where users stake funds in a shared pool that earns interest in a money market. After a set time, a winner is randomly chosen to receive the interest, while other players get their original stake back.[13]

NFTs can also leverage smart contracts to introduce randomness, enabling features like unpredictable loot drops for players.[14] Chainlink oracles and smart contracts played a key role in ensuring the fairness and security of MLB player Trey Mancini's NFT collection drop in 2021. This drop included features like unique asset verification and a chance to win prizes.

Real Estate

Smart contracts hold the potential to transform the real estate industry by fostering both increased security and efficiency in property transactions.[15] Traditionally, real estate transactions have been characterized by cumbersome paperwork and a lengthy chain of intermediaries, leading to higher costs and delays.

Ecosystem Providers

Several leading companies and organizations, including IBM, Microsoft, Baidu, the Ethereum Foundation, and Chainlink, are driving innovation in the blockchain environment by providing solutions and platforms that facilitate the creation, deployment, and management of smart contracts. As more institutions embrace blockchain technology and integrate it into their operations, we can expect to see a surge in novel applications within this space.

Learn More

BITA goes beyond traditional sector-based indexing by offering thematic universes focused on emerging areas like blockchain and distributed ledger technology (DLT). Our proprietary research team identifies companies actively developing smart contract technologies within this universe. This includes promising areas such as crypto payments and blockchain software development. As these technologies gain wider acceptance, we can expect a future with more complex and useful applications across various sectors, all secured within an encrypted environment.

Explore the world of investing in blockchain and DLT with the Bita NFT and Blockchain Giants Index and Bita NFT and Blockchain Select Index.

Due to limitations in loop functions, the Bitcoin Script programming language is not widely used for complex smart contracts. ↩︎

Compendium (2022). “A Brief History of Smart Contracts: From Concept to Implementation.” ↩︎

Hinkes, s.f. ↩︎

The DAO was “an experimental venture capital fund heralded by its supporters as a new model for organizing a business,” Verstraete, 2019, p. 776. ↩︎

Verstraete, 2019. ↩︎

This refers to the information that is outside of the Blockchain environment and can only be assessed with Oracle Chainlink. ↩︎

Chainlink, 2019. ↩︎

Arbol, n.d. ↩︎

Chainlink, 2019. ↩︎

Chainlink, 2019. ↩︎

Hamilton, 2023. ↩︎

Chainlink, 2019. ↩︎

Chainlink, 2023. ↩︎

Chainlink, 2023. ↩︎

SoluLab, 2023. ↩︎

References

Arbol. (n.d.). Arbol. Retrieved from https://www.arbol.io/post/smart-contracts-and-blockchain-can-help-close-the-global-protection-gap-enable-businesses-to-build-climate-resilience

Chainlink. (2019, May 17). Chainlink. Retrieved from https://blog.chain.link/smart-contract-use-cases/

Chainlink. (2023, November 29). Chainlink. Retrieved from https://chain.link/education/smart-contracts#history-of-smart-contracts-2

Chainlink. (2024, January 12). Retrieved from https://chain.link/education/blockchain-oracles

Compendium. (2022, December 8). Retrieved from https://compendium.finance/education-resource/a-brief-history-of-smart-contracts-from-concept-to-implementation-1670264972161x626976571783759900

Dancuk, M. (2023, February 9). Retrieved from phoenixnap: https://phoenixnap.com/kb/boolean-data-type#:~:text=A%20boolean%20is%20a%20data,algebra%2C%20named%20after%20George%20Bool.

Devpost. (2020). Retrieved from https://devpost.com/software/the-open-library-project

Ethereum. (2024, 03 07). Retrieved from https://ethereum.org/en/smart-contracts/

Grand View Research. (n.d.). Retrieved from https://www.grandviewresearch.com/industry-analysis/smart-contracts-market-report

Hamilton, D. (2023, May 30). Securities.io. Retrieved from https://www.securities.io/investing-in-pickle-finance/

Hinkes, A. (s.f.). Retrieved from https://jcl.law.uiowa.edu/sites/jcl.law.uiowa.edu/files/2021-08/Hinkes_Final_Web_0.pdf

Jünemann, M., & Milkau, U. (2021, July 27). Can Code Be Law. Bird&Bird&DLT, pp. 1-13. Retrieved from https://www.twobirds.com/-/media/pdfs/news/articles/2021/junemann-milkau-2021-can-code-be-law-download.pdf?la=en&hash=D0B27FA83BFCB3FC5D27739B9F868C7BCF0AA780

Lia, R. A. (2023). ASSESSING THE POTENTIAL OF DECENTRALISED FINANCE AND BLOCKCHAIN TECHNOLOGY IN INSURANCE. Retrieved from The Geneva Association: https://www.genevaassociation.org/sites/default/files/2023-08/DeFi%20insurance_WEB.pdf

Liveplex. (2024, February 26). Slideshare. Retrieved from https://es.slideshare.net/slideshow/the-evolution-of-smart-contracts-transforming-business-processes/266506386

Lyra. (2021, August 30). Retrieved from https://blog.lyra.finance/lyra-integrates-chainlink-price-feeds/

Mik, E. (2017, 10). Smart Contracts: Terminology, Technical Limitations and Real World Complexity. Research Collection School Of Law., 9, pp. 269-300. Retrieved from https://core.ac.uk/download/pdf/132698353.pdf

Pickle Finance. (2022, March 28). Medium. Retrieved from https://picklefinance.medium.com/pickle-finance-univ3-jars-powered-by-chainlink-keepers-8ce1756a2497

Raskin, M. (2017). ILSA. Retrieved from https://georgetownlawtechreview.org/wp-content/uploads/2017/05/Raskin-1-GEO.-L.-TECH.-REV.-305-.pdf

Skadden. (n. d.). Retrieved from https://www.skadden.com/-/media/files/publications/2018/05/cybersecurity_smartcontracts_050818.pdf

SoluLab. (2023, December 6). Slideshare. Retrieved from https://es.slideshare.net/slideshow/smart-contracts-and-their-role-in-blockchain-developmentpdf/264349124?_gl=1*scyeta*_gcl_au*MTc2NTU5OTMxNS4xNzE3NDM3MTA5

Szabo, N. (1994). Retrieved from https://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart.contracts.html

Verstraete, M. (2019). The Stakes of Smart Contracts. Loyola University Chicago Law Journal, 50(3), pp. 743-795. Retrieved from https://lawecommons.luc.edu/cgi/viewcontent.cgi?article=2692&context=luclj

Wikipedia. (n.d.). Retrieved from https://en.wikipedia.org/wiki/Scripting_language

Wikipedia. (n.d.). Retrieved from https://en.wiktionary.org/wiki/ex_post

Zhang, Z., Zhang, B., Xu, W., & Lin, Z. (n.d.). Retrieved from https://www.cs.purdue.edu/homes/zhan3299/res/ICSE23.pdf