Video Gaming: Anatomy of the entertainment industry’s leading segment

• Video gaming has grown to become the largest revenue segment within the entertainment industry, surpassing music, film, and television combined.

• The video gaming industry continues to showcase robust growth, with its innovative approach and adoption of groundbreaking technologies propelling it to the forefront of the entertainment sector.

• The video gaming industry is capitalizing on emerging trends such as e-sports, cloud gaming, virtual and augmented reality, metaverse, and artificial intelligence.

• BITA’s indexes and thematic universes thoroughly cover the areas influenced by the growth in video games and e-sports.

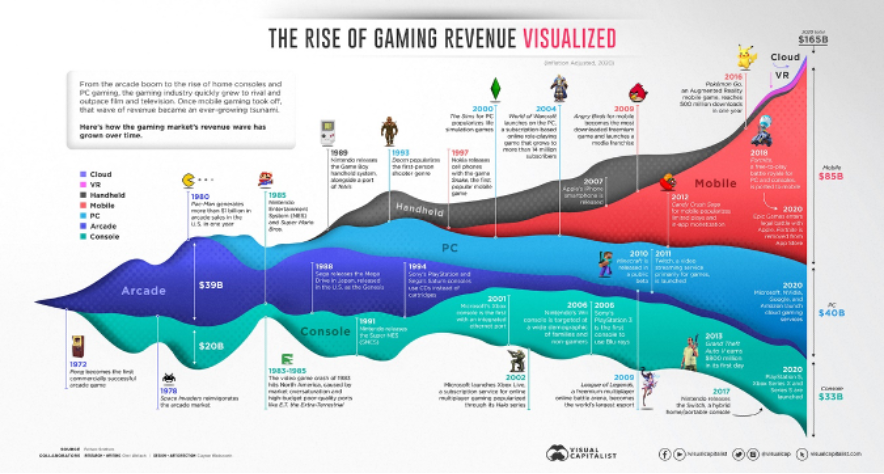

The video gaming market has gone from being a marginal entertainment industry in the 1980s to the sector with the highest source of revenues in this area, at $184 billion in 2022. Video gaming revenue is almost double that of film and television at $94 billion and exceeds that of music at $64 billion. This growth has been achieved in less than 50 years. Over this period, some interesting hallmarks of the industry have presented themselves: features of shifting demographics and heavily technology-dependent products.

The global gamer population is projected to increase from 3.2 billion in 2022 to 3.6 billion by 2025. It’s not just kids either: 38 percent of gamers are between 18 and 34 years old, and 16 percent are older than 55.

Moreover, during the COVID pandemic, the industry demonstrated its resilience, serving as both a form of escapism and a means of social connection.

A noteworthy aspect of the video gaming industry is its low barriers to entry, as small and medium-sized companies and even sole-proprietors can turn an idea into a million-dollar game. New companies have the opportunity to enter the market and quickly become a competitive threat to established market leaders.

All these characteristics show the immense investment potential the industry currently offers. But what does the future hold?

As we can see in the graph, the industry has grown on three major platforms: Console Gaming, PC Gaming, and Mobile Gaming, the latter being the more impactful on the future of the video gaming market: massive games, multiplatform and overall, microtransactions. Furthermore, the video gaming industry has begun to focus on new trends such as:

1. e-Sports:

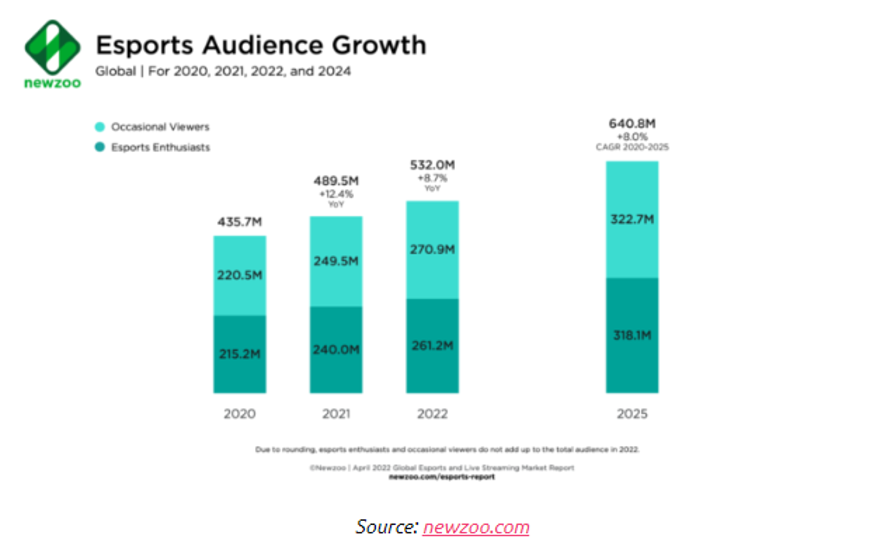

The term “eSports” is characterized by regional or international video gaming events in which professional and amateur players compete against each other. In 2022, according to the InfluencerMarketingHub, the global eSports market was valued at just over 1.38 billion U.S. dollars. The largest share of eSports market revenue came from sponsorships and advertising in 2021. Altogether, global eSports revenue from sponsorships and advertising totaled 837 million U.S. dollars in 2021. The next highest source of revenue, in contrast, was media rights at just over 207 million U.S. dollars. 2022 worldwide eSports audience size reached 532 million people. By 2025, there are expected to be over 640 million viewers of eSports worldwide, a CAGR of 8%.

2. Cloud gaming:

This is a way to play video games through an Internet connection, without the requirement to download or install the games on a local device - i.e., play from the cloud without using space on a computer. The main advantages offered by this service is play from a modest computer, without having to invest in expensive hardware, at any time and place with a stable Internet connection, and without taking up resources from the computer. It also always allows a fully updated catalog of games. Cloud disadvantages are dependance on a strong internet connection for the more advanced games and the rotation of the game catalog – users are subject to games that are available in the library at time of playing and do not own the game outright.

3. Virtual and Augmented Reality:

The main difference between AR and VR is that the first adds virtual elements to the real world, while the second creates a new virtual world that users can immerse themselves in and explore.

Virtual Reality (VR), when implemented properly, can be an incredibly engaging sensory ride. Using computer-generated imagery (CGI), there are no limits aside from money and imagination when creating other worlds, product demos, or spaces in novel and fascinating ways. However, VR is a fragmented market, as it is in the early adoption stage, and content created for one platform will usually not work with another. Also, the equipment required is expensive. For example, headset pricing can reach USD 1,500, and there are many choices with widely varying capabilities in between.

Augmented Reality (AR), used properly, has proven to be a very useful and engaging information layered onto a real-world scene. AR apps using smartphones are well-established. Even one of the most impactful games in the last ten years (Pokemon Go) comes from an AR game that went viral worldwide. However, as with the VR, the equipment required can be pricey (AR headsets prices are between USD 2,000 to USD 3,500) and have some limitations in their current forms, like having a limited range, and the gesture controls are somewhat difficult to use.

4. Metaverse:

Game developers have been building digital worlds for decades, and the rise of the metaverse poses new challenges for companies. Video game technology is invaluable to the metaverse is because they have laid the foundation for the project that companies like Meta want to build. And in turn, metaverse advancements can have an effect on video gaming as more resources are put into the large-scale projects.

Almost 20 years ago, Philip Rosedale launched Second Life, a virtual community developed by Linden Lab, onto the market. Now, with all the advances the industry has reached in this field, in terms of processing capacity, graphics, and interconnection, a world of new possibilities opens for all video game development companies to benefit from.

5. Artificial Intelligence:

Artificial intelligence has been used in gaming for decades — most prominently in non-player characters (NPCs), like the ghosts in Pac-Man or the bystanders in Grand Theft Auto.

In recent years, game makers have taken a more sophisticated approach to NPCs. Many NPCs are now programmed with behavior trees, which allow them to perform more complex decision-making.

AI isn’t just part of the gameplay experience though. It’s part of the game-making experience. For several years now, designers have been using AI to help them generate game assets, or even to create game levels, using a technique called procedural content generation, which has become standard practice in the industry.

Finally, while AI may not create entire games yet, AI-generated art may change the graphics industry in the future easing the burden of the art/animation departments.

In summary, the future and growth of this industry have not reached a ceiling for a multitude of reasons that are the foundations of the video gaming success story. Application of new technologies and the video gaming industry serving as a pioneer further fuels its continued market share growth.

BITA’s indexes and thematic universe thoroughly cover each area impacted by growth in video games and e-sports. Our representative indexes are:

• BITA Gaming and E-Sports Giants EW Index

• BITA Global Metaverse Index

• BITA Metaverse Giants Index

Thematic universes dedicated to the relevant topics are:

• Video games and e-sports

• Cloud Computing

• Virtual and Augmented Reality

• Metaverse

• Artificial Intelligence

These indexes and universes allow our clients to observe and analyze the behavior of all companies with revenue exposure to the industry and related fields.

Sources:

https://www.zionmarketresearch.com/report/global-movies-entertainment-market#:~:text=The global movies and entertainment,7.21%25 between 2023 and 2030.

https://www.researchandmarkets.com/reports/5411285/global-music-market-recorded-music-streaming-and#:~:text=The Global Music Market was,at %2464.23 Billion in 2022.

https://exputer.com/guides/cloud-gaming/

https://www.encora.com/insights/virtual-and-augmented-reality-pros-and-cons

https://builtin.com/media-gaming/future-of-gaming

https://resources.newzoo.com/hubfs/Reports/Games/2022_Newzoo_Free_Global_Games_Market_Report.pdf

https://www.theesa.com/wp-content/uploads/2021/08/2021-Essential-Facts-About-the-Video-Game-Industry-1.pdf

https://www.visualcapitalist.com/50-years-gaming-history-revenue-stream/